Enroll during Open Enrollment

Use this task to change/update your benefits coverage for

the coming year.

You

have received notification through your company that it is time

to complete Open Enrollment. By Clicking on Open Enrollment under

Benefits on the menu, you will be able to complete the Open Enrollment

wizard to make your selections for the upcoming year.

|

To enroll in Benefits through Open Enrollment:

Notes:

These instructions

only apply if you have previously been enrolled in benefits, and are

signing up again or changing elections during the Open Enrollment

period.

If you have NEVER

enrolled in benefits before (that is, you are eligible for the first

time), you may proceed with enrolling in benefits for the next plan

year using the Open Enrollment page (as outlined in this topic). However,

if you are newly eligible to enroll for benefits for the current

plan year, you will first need to use the New

EnrollmentNew

Enrollment link to select your benefit elections

for the remainder of the current plan year before confirming the continuation

of your elections via Open Enrollment for the following plan year.

An Add Dependent

button is available, allowing you to enroll dependents WITHOUT using

a Life Event.

You can return

to the Current Elections area to add or change beneficiaries at any

time in the plan year.

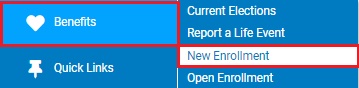

1. On the Menu, click Benefits

> Open EnrollmentBenefits

> Open Enrollment.

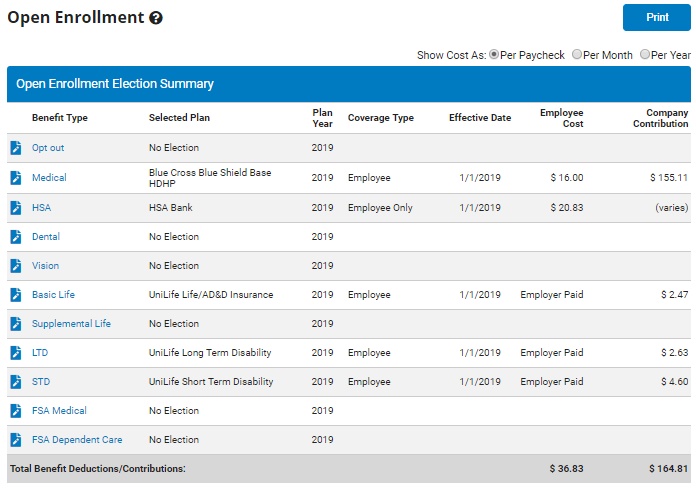

The Open

Enrollment Elections SummaryOpen

Enrollment Elections Summary page displays.

2. In the Benefit

TypeBenefit

Type column, click the desired Benefit Type link or

click the corresponding ChangeChange

button.

Note: The

types of benefit coverage plans below are for example and may not reflect

the exact plan offering provided by your employer.

1. Click the ChangeChange

button or the corresponding the Medical in the Benefit Type column.

2. In the Select column of the Plan Enrollment

page, click the radio button next to the desired plan name to select

or Coverage Waived.

Note:

Depending on your tobacco status,

you may only be eligible for certain plans. If you are unsure which

medical coverage plan your company uses for smokers, contact your

Benefits Administrator.

3. Mark the check box for each Covered

Persons to be included in the plan.

Notes:

4. Click the Save

button to record your entries.

1. Click the ChangeChange

button or the corresponding Dental link in the Benefit Type column.

2. In the Select column of the Plan Enrollment

page, click the radio button next to the desired plan name to select

or Coverage Waived.

3. Mark the check box for each Covered

Persons to be included in the plan.

Notes:

4. Click the Save

button to record your entries.

1. Click the ChangeChange

button or the corresponding Vision link in the Benefit Type column.

2. In the Select column of the Plan Enrollment

page, click the radio button next to the desired plan name to select

or Coverage Waived.

3. Mark the check box for each Covered

Persons to be included in the plan.

Notes:

4. Click the Save

button to record your entries.

1. Click the ChangeChange

button or the corresponding Supplemental Life link in the Benefit

Type column.

2. Click the ViewView button or the employee's/dependent's

name link next to the employee or eligible dependent to be covered.

3. Enter the desired amount of coverage

in the Elected Annual Coverage box. Or, if your employer offers salary-based

coverage, you can select a coverage level in the Elected Coverage

Level drop-down list instead.

Notes:

The amount of

coverage must be more than the Min limit, less than the Max limit,

and in an increment shown in the table.

You might be

required to complete an Evidence of Insurability (EOI) form before

you can elect coverage and add beneficiaries.

The actual Coverage

Amount may not match your Elected Coverage Level if, for example,

your selection is lower than the minimum limit, higher than the

maximum or GI limit, or you are in Age Reduction status.

4. To obtain Accidental Death and Dismemberment

(AD&D) coverage, indicate the desired

coverage amount in the separate AD&D

row.

Note: The

AD&D coverage amount can be different from the amount of life

insurance coverage.

5. Select to show costs as either Per Paycheck,

Per Month, or Per Year.

6. To change the tobacco status for this

individual, mark the appropriate Change Tobacco Status radio button.

Note: The rate

applicable to this plan is determined, in part, by the covered person's

use of tobacco products in the past 12 months.

7. Click the Add Primary BeneficiaryAdd Primary Beneficiary

button to add who will receive the benefits of the Supplemental Life

policy.

8. In the % of Benefit column, enter the

individual percentages for each beneficiary listed.

Notes:

9. Click the Add

Secondary BeneficiaryAdd

Secondary Beneficiary button to add who

will receive the benefits of the policy in the event that no primary

beneficiaries are living at time of disbursement.

10. In the % of Benefit column, enter the individual

percentages for each beneficiary listed.

Notes:

11. Click the Save

button to record your entries.

12. Click the Return

to Previous Screen button.

To

enroll in Long Term Disability coverageTo

enroll in Long Term Disability coverage

1. Click the ChangeChange

button or the corresponding Long Term Disabiliity (LTD) link in the

Benefit Type column.

2. If your company offers more than one

long term disability plan, click the radio button next to the desired

plan.

Note:

If your company offers a buy up plan, you may select increasing

amounts of long term disability coverage from this screen as well.

3. If your company allows you to set how

your plan applies to your income taxes, select an option from the

Pre-Tax/Post-Tax drop-down box.

Note:

Contact your HR Administrator if you are unsure what this drop-down

box means.

4. Click the Return

to Previous Screen button to record your entries.

To

enroll in Short Term Disability coverageTo

enroll in Short Term Disability coverage

1. Click the ChangeChange

button or the corresponding Short Term Disability (STD) link in the

Benefit Type column.

2. If your company offers more than one

short term disability plan, click the radio button next to the desired

plan.

Note:

If your company offers a buy up plan, you may select increasing

amounts of short term disability coverage from this screen as well.

3. Click the Return

to Previous Screen button to record your entries.

1. Click the ChangeChange

button or the corresponding Flexible Spending Account (FSA) Medical

link in the Benefit Type column.

Note: You

can use the worksheet to estimate medical costs for the upcoming plan

year.

2. Enter the total amount to save into

your FSA plan for the plan year in the Annual Contribution box.

Note: The system

will automatically calculate the amount of your paycheck deduction

based on the total number of paychecks scheduled for the remainder

of the FSA plan year.

3. When your election is complete, click

the Save button to record

your entries.

1. Click the ChangeChange

button or the corresponding Flexible Spending Account (FSA) Dependent

Care link in the Benefit Type column.

Note: You can

use the worksheet to estimate dependent care costs for the upcoming

plan year.

2. Enter the total amount to save into

your FSA plan for the plan year in the Annual Contribution box.

Note: The system

will automatically calculate the amount of your paycheck deduction

based on the total number of paychecks scheduled for the remainder

of the FSA plan year.

3. When your election is complete, click

the Save button to record

your entries.

3. Click the PrintPrint

button to print a hard copy of your benefits elections.

4. After reviewing your benefits elections, click

the SubmitSubmit

button to close out your selections.

Note: The Benefits

Enrollment Confirmation page displays.

5. Confirm your elections, and then click the Approve button.

Note: You can click

the Cancel button instead to return

to the Open Enrollment page and make further changes.