The options available in this task may vary from company to company. Not all companies have 401(k); some may have 403(b), etc.

|

You want to see how much you and your company have contributed to your 401(k)/403(b) plan this year. By clicking on the 401(k)/403(b) area, you will be able to see your current contribution balances for the calendar year, as well as view past year contribution amounts. |

To view your 401(k)/403(b) information:

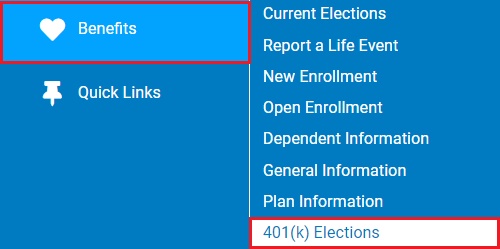

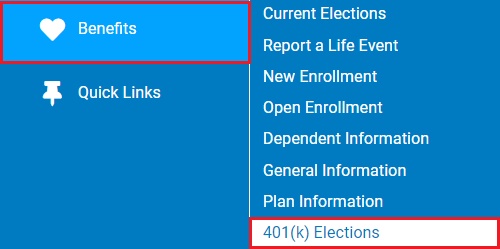

1. On the Menu, click Benefits > 401(k) ElectionsBenefits > 401(k) Elections (403(b) Elections).

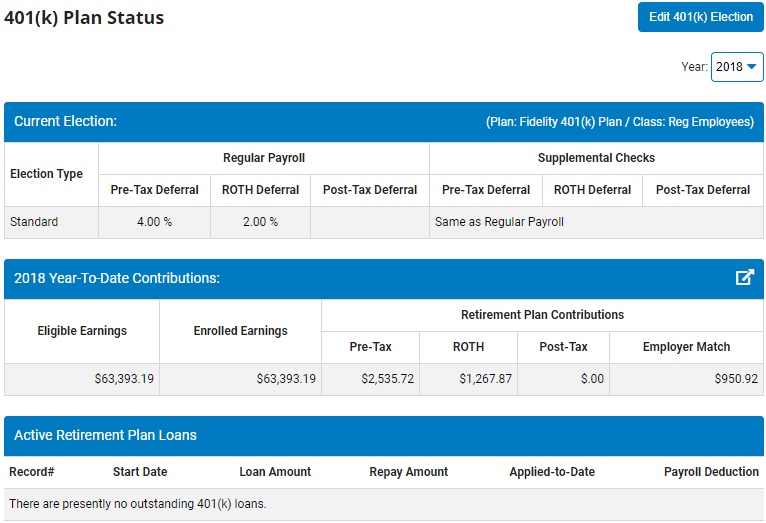

The 401(k) Plan Status401(k) Plan Status (403(b) Plan Status) page displays, showing current elections, year-to-date contributions, and any active loans.

Employees eligible for participation in the retirement plan deferrals are able to set different deferral elections for regular vouchers (typically regularly-scheduled payrolls) and special payouts that are separated to a "supplemental" pay voucher (such as a bonus).

Note: The 401(k) Plan Status page may additionally display a Special Payroll Runs OnlySpecial Payroll Runs Only section. If made available by your employer, this provides users the option to designate a third/separate set of deferral elections that are to be solely used for specialized payrolls (such as profit sharing or an annual bonus payout).

2. To view information for a different year, click the YearYear drop-down box and select a year.

The 401(k) Plan Status page updates with the new year information.

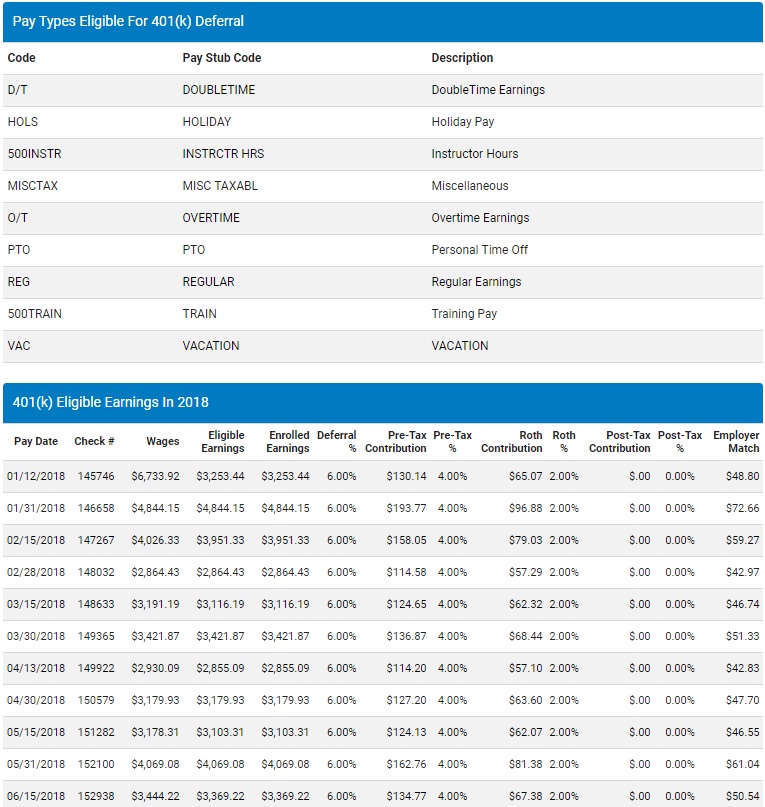

3. To view 401(k) earnings details, click the DetailsDetails button.

The DetailsDetails page displays where you will find information such as Pay Types Eligible for 401(k) Deferral, Eligible Earnings, Contributions, and Employer Match.