A Flexible Spending Account (FSA) allows you to save money while excluding it from income taxes. The money saved must be used during the plan year to reimburse eligible expenses incurred during the plan year.

There are two types of Flexible Spending Accounts, Medical and Dependent Care Flexible Spending.

It

is nearing the end of the calendar year and you are needing to

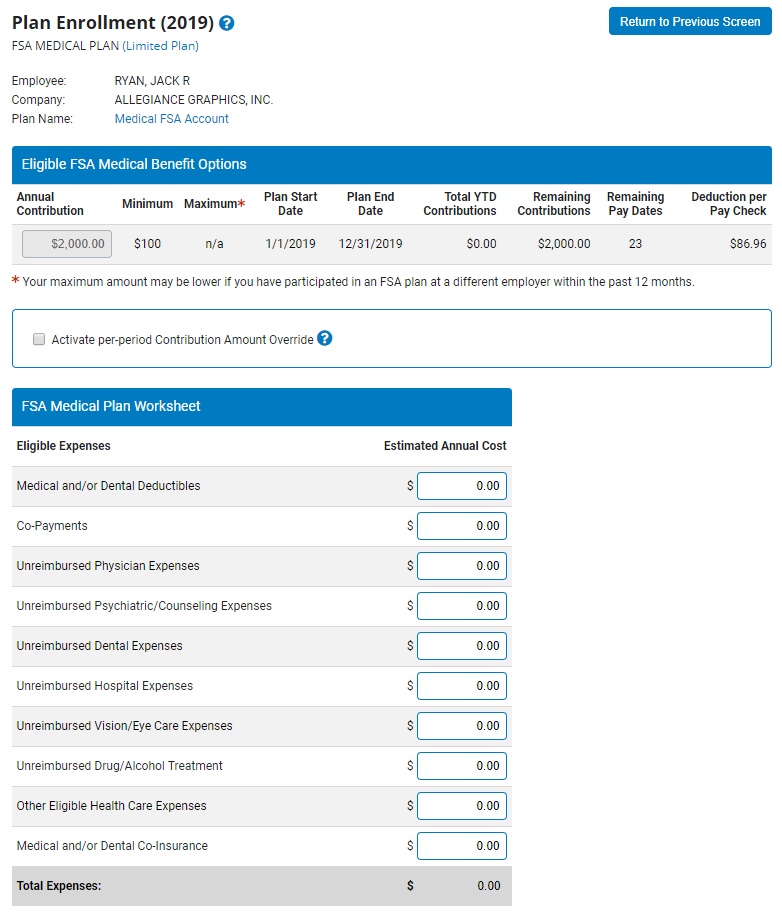

ensure that you have spent the appropriate money for your Medical

FSA deductions. By viewing your election amount, you will be able

to see the amount you have committed to and ensure you will be

able to submit the appropriate amount in medical deductions. |

To view your flexible spending account(s):

1. On the Menu, click Benefits > Current ElectionsBenefits > Current Elections.

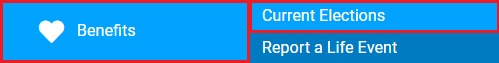

The Current ElectionsCurrent Elections page displays.

2. To view employee cost per paycheck, per month or per year, click a radio button in the Show Cost AsShow Cost As section of the Current Benefit Enrollment Status table.

3. Select the FSA MedicalFSA Medical link or click the ViewView button next to FSA Medical.

The Plan EnrollmentsPlan Enrollments page displays.

4. Enter the total amount to save into your FSA plan for the plan year in the Annual ContributionAnnual Contribution box.

Notes:

The system requires you to enter an annual election.

The system will automatically calculate the amount of your paycheck deduction based on the total number of paychecks scheduled for the remainder of the FSA plan year.

The FSA Worksheet can be used to estimate an appropriate Annual Contribution.

5. When your election is complete, click the SaveSave button to exit.

![]()

6. Select the FSA Dependent CareFSA Dependent Care link or click the ViewView button next to FSA Dependent Care.

![]()

![]()

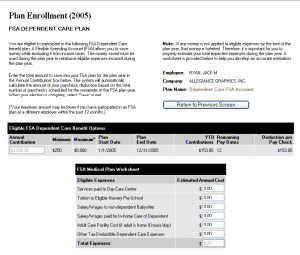

The Plan EnrollmentsPlan Enrollments page displays.

7. Enter the total amount to save into your FSA plan for the plan year in the Annual ContributionAnnual Contribution box.

Notes:

The system requires you to enter an annual election.

The system will automatically calculate the amount of your paycheck deduction based on the total number of paychecks scheduled for the remainder of the FSA plan year.

The FSA Worksheet can be used to estimate an appropriate Annual Contribution.

8. When your election is complete, click the SaveSave button to exit.

![]()