State Worker's Compensation Rates vary by state and organization. You may customize state worker's compensation rates with this code.

To change state worker's compensation rates:

1. On the Management Navigation Menu, click Settings > Company CodesSettings > Company Codes.

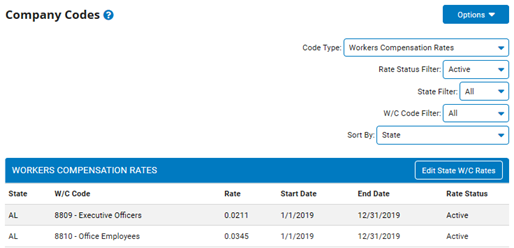

The Company CodesCompany Codes page displays.

2. Select the Worker's Compensation Rates option from the Code TypeCode Type drop-down box.

A list of all existing Worker's Compensation Rates displays in the Worker's Compensation RatesWorker's Compensation Rates table.

Note: You may sort compensation rates by the criteria listed in the drop-down box filters, if necessary.

3. Click the Edit State W/C Rates button.

The Worker's Compensation Rate SetupWorker's Compensation Rate Setup page displays.

4. Select the state in which you want to edit compensation rates from the Select a State drop-down box.

The Worker's Compensation Rate Setup page updates to display existing compensation rates for the state you selected.

5. Select a rate period from the Rate Period drop-down box.

The rates you edit will only be applicable within the Rate Period you select.

Note: You may create a new Rate Periodcreate a new Rate Period if necessary.

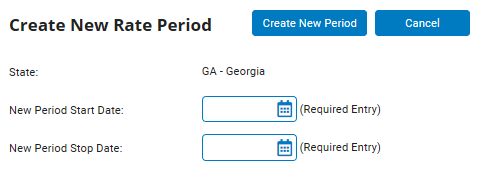

To create a new rate period:

1. Click the Create New Rate PeriodCreate New Rate Period button.

The Create New Rate PeriodCreate New Rate Period pop-up window displays.

2. Enter a start date for the period in the New Period Start Date text box (you may also select the date from a calendar by clicking the Calendar button).

Note: Any new rate period you add cannot overlap an existing rate period; it must start after the existing rate period ends.

3. Enter an end date for the period in the New Period End Date text box (you may also select the date from a calendar by clicking the Calendar button).

4. Click the Create New PeriodCreate New Period button.

Result: The pop-up window closes. You may now select the new Rate Period you created from the Rate Period drop-down box.

6. Enter a new rate for the categories of compensation rate (or W/C code) in the New Rate text box. Leave those W/C codes you do not wish to change blank.

Note: You may check the Show Inactive W/C Codes checkbox to view W/C does that have previously been inactivated.

7. Click the SubmitSubmit button.

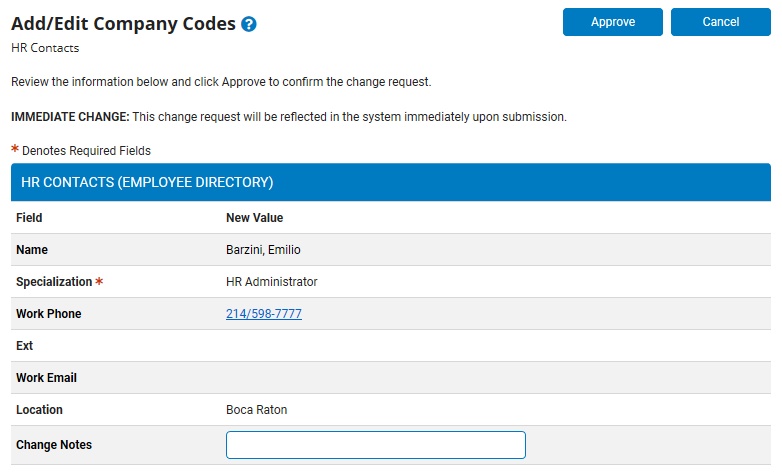

The Confirm Contact AdditionConfirm Contact Addition page displays.

8. Enter any notes related to the addition of this HR contact in the Change NotesChange Notes text box.

9. Click the ApproveApprove button

Result: The state worker's compensation rates for the W/C codes you selected are updated in ExponentHR. The Company Codes page displays.