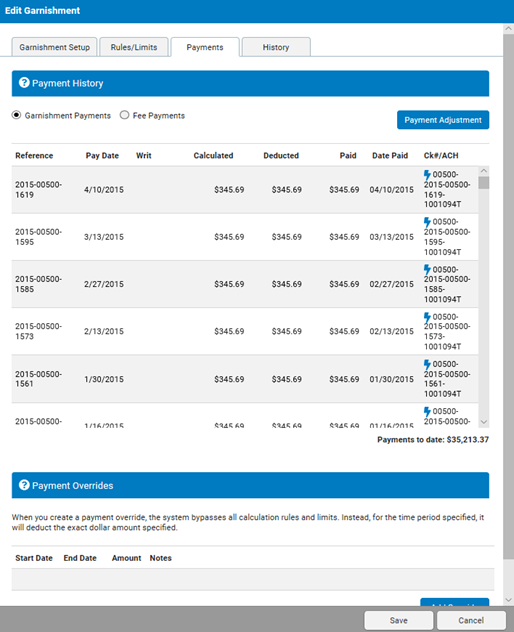

When you create a payment override, the system bypasses all calculation rules and limits. Instead, for the time period specified, the system deducts the exact dollar amount specified.

If you need to refund money to the employee (that was held for a writ option, for example), you can enter a one-time payment override as a negative amount. Another option is to pay the employee through an off-cycle batch and record a negative adjustment in the garnishment record.

To create a garnishment payment override:

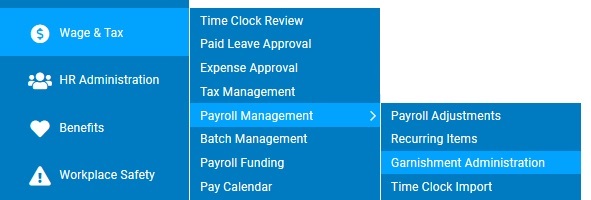

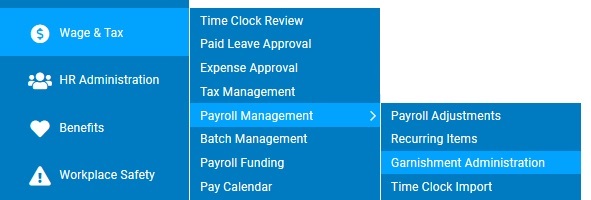

1. On the Management Navigation Menu, click Wage & Tax > Payroll Management > Garnishment AdministrationWage & Tax > Payroll Management > Garnishment Administration.

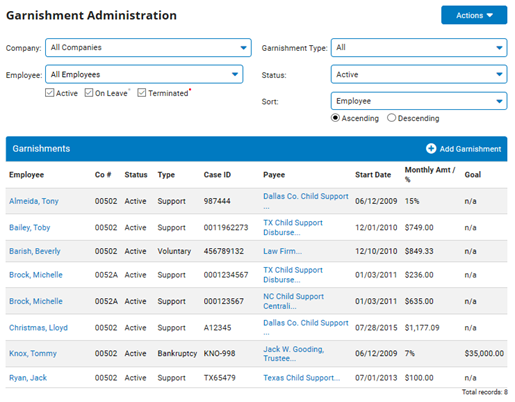

The Garnishment AdministrationGarnishment Administration page displays.

2. Click the employee name in the row of the garnishment for which you want to create a payment override.

The Garnishment SetupGarnishment Setup tab displays.

.jpg)

3. Click the Payments tab.

The PaymentsPayments tab displays.

4. Click the Add Override button.

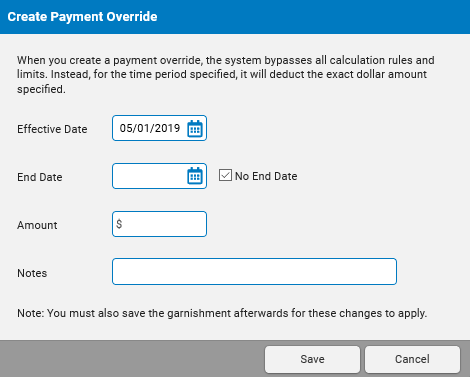

The Create Payment OverrideCreate Payment Override popup displays.

5. Enter the start and end dates for the override.

Note: If the end date is not known, select the No End Date check box.

6. Type the amount of the override.

7. Type any notes for your reference.

8. Click the Save button to record the override.

9. Click the Save button to exit the garnishment and keep the changes made.