Use this report to print or export recurring earnings, or deductions, or employer contribution information. By default, the report includes Employee, Type, Code, Record Number, Status, Start Date, Frequency, Amount per Period, and Goal Amount.

To run this report:

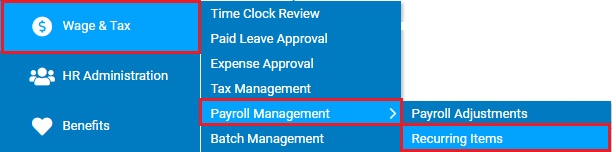

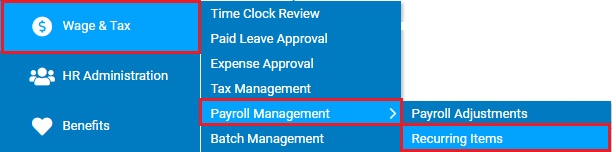

1. On the Menu, click Wage & Tax > Payroll Management > Recurring ItemsWage & Tax > Payroll Management > Recurring Items.

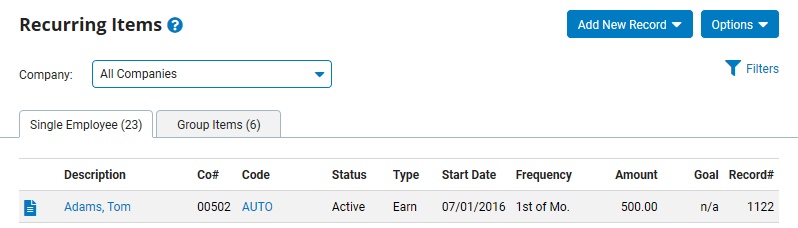

The Recurring ItemsRecurring Items page displays.

2. Select Recurring Items Report from the Options button.

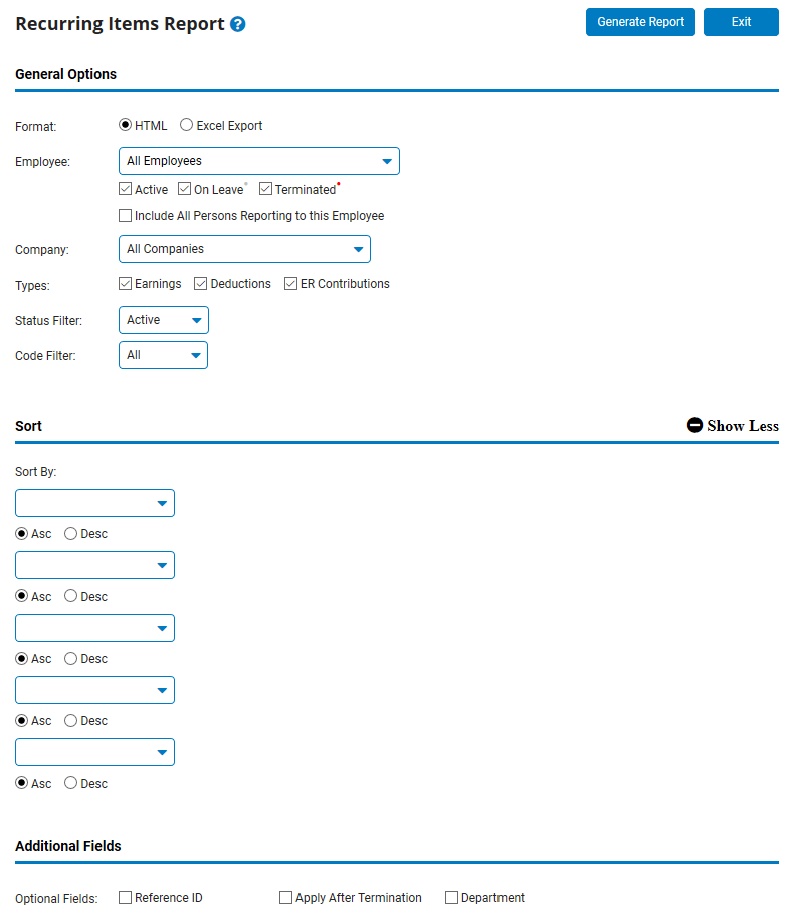

The Recurring Items ReportRecurring Items Report page displays.

3. Select the report format from the Format radio buttons.

Notes:

Select the HTML radio button to view the report in a new browser window.

Select the Excel Export radio button to view the report in Microsoft Excel.

4. If necessary, select a specific employee from the Employee drop-down box to view earnings and deductions adjustments for that employee only.

Note: Leave the field set to All Employees to view a report including all employees at your company.

5. Select the Earnings check box to include earnings adjustments in the report, the Deductions check box to include deductions adjustments, and/or the ER Contributions check box to include employer contributions from the Types check boxes.

6. You may show adjustments in a specific status only by selecting the appropriate status from the Status Filter drop-down box.

Note: Set this drop-down box to All to include adjustments in all statuses.

7. You may show adjustments assigned to a specific code filter only by selecting the code filter from the Code Filter drop-down box.

Note: Leave this set to All to include adjustments assigned to all code filters.

8. If necessary, configure the Sort to control the presentation of the detailed data within the designated groupings.

9. If necessary, designate the columns you would like included in the formatted results by selecting the check box for each optional field in the Additional Fields section of the report.

10. Click the Generate Report button.

Result: The report you selected displays in a new window with the options you selected.

Notes:

You may print the report by clicking the Print button.

You may close the report by clicking the Close button.