The Company Profile report lists the company name, address, payroll controls, and tax profile. Use it to verify that the company’s master data is set up correctly and completely.

To run this report:

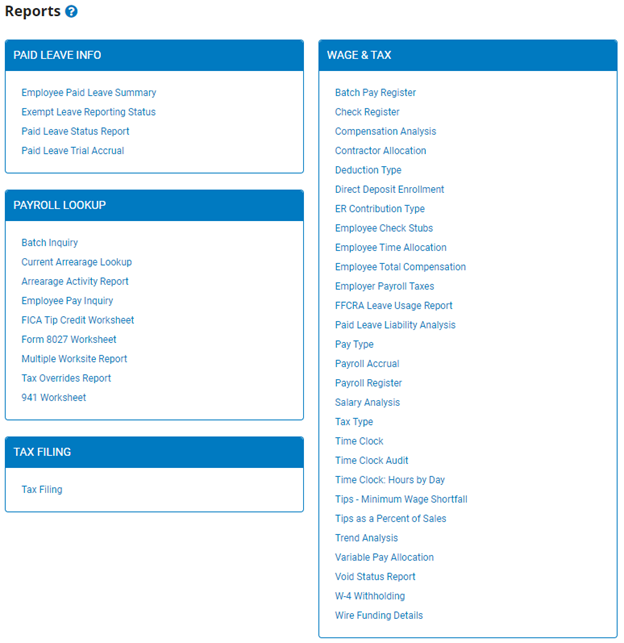

1. On the Menu, click Wage & Tax > ReportsWage & Tax > Reports.

The reports availablereports available menu displays.

2. Click the Tax Filing link.

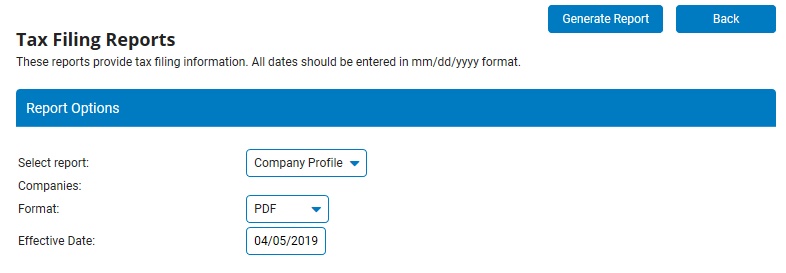

The Tax Filing ReportsTax Filing Reports page displays.

Note: This same page may also be accessed through the Tax Reports drop-down list in the Tax Management utility.

3. Select Company Profile from the Select report drop-down list (if not already selected).

4. If your organization has more than one company, select the company (or companies) for which you want to run the report.

5. Select the output of the report in the Format drop-down list.

You can choose to format the report as a PDF, tab-delimited text, HTML, RTF, or XML, depending on how you are going to use the report.

6. The effective date defaults to the current date, but you can type another date in the Effective Date text box (in mm/dd/yyyy format).

7. Click the Generate Report button.

Result: The report you selected displays in a new window with the options you selected. When you are done viewing the report, close the report window.

Related Help Topics: