The Liability Analysis report lists company tax liabilities, along with any variances. You can use it to review only deposited liabilities or only pending ones.

To run this report:

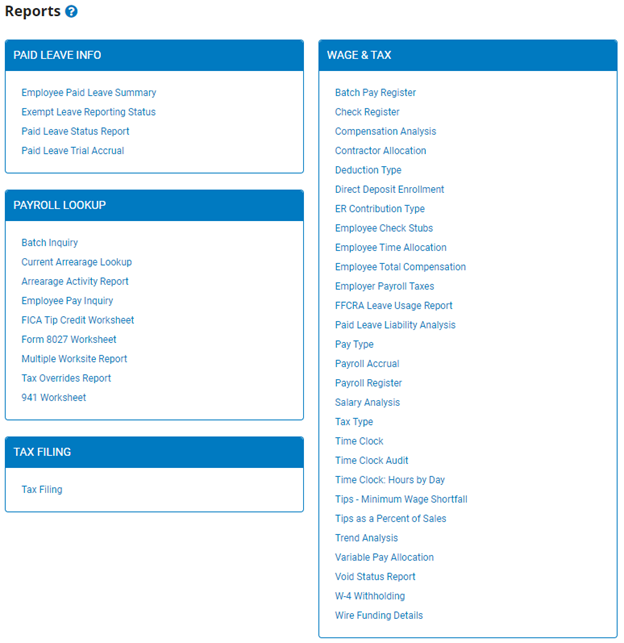

1. On the Menu, click Wage & Tax > ReportsWage & Tax > Reports.

The reports availablereports available menu displays.

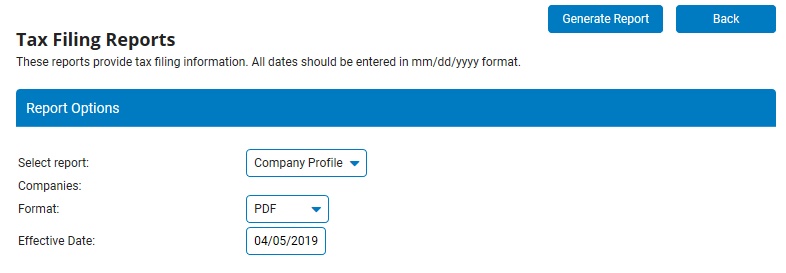

2. Click the Tax Filing link.

The Tax Filing ReportsTax Filing Reports page displays.

Note: This same page may also be accessed through the Tax Reports drop-down list in the Tax Management utility.

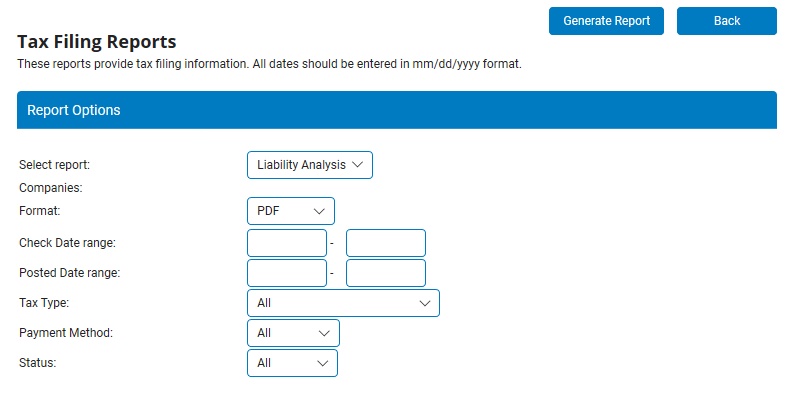

2. Select Liability Analysis from the Select Report drop-down list.

The Tax Filing ReportsTax Filing Reports page updates.

Note: This same report may also be accessed through the Tax Reports drop-down list in the Tax Management utility.

3. If your organization has more than one company, select the company (or companies) for which you want to run the report.

4. Select the output of the report in the Format drop-down list.

You can choose to format the report as a PDF, tab-delimited text, HTML, RTF, or XML, depending on how you are going to use the report.

5. If you want to limit the liabilities to a particular range of check dates, type the first and last dates in the Check Date Range text boxes (in mm/dd/yyyy format).

6. If you want to limit the liabilities to a particular posted date range, type the first and last dates in the Posted Date Range text boxes (in mm/dd/yyyy format).

Note: Either a Check Date range or a Posted Date range is required. The maximum allowable range for both fields is one year. Years do not need to start on January 1.

7. If you want to limit the liabilities to a particular range of deposits, type the first and last dates in the Deposit Date Range text boxes (in mm/dd/yyyy format).

8. By default, the deposits of all types of taxes will be included. You can, however, choose to limit the deposits to those of a particular tax type by selecting Federal/State Withholding, Federal/State Unemployment, or Local from the Tax Type drop-down list.

9. By default, all deposits will be included in the report, regardless of their payment method. You can, however, choose to limit the report to include only deposits that were paid by Check, EFT, EFT Credit, EFT Debit, Wire, or Wire-NC by selecting from the Payment Method drop-down list.

10. By default, all deposits will be included regardless of their status. You can, however, choose to limit the report to include deposits of a particular status by selecting one of the following from the Status drop-down list:

• Deposited List only deposits that have been paid.

• Pending List only deposits that are still pending.

11. Click the Generate ReportGenerate Report button.

Result: The report you selected displays in a new window with the options you selected. When you are done viewing the report, close the report window.

Related Help Topics: