Upon calculation of your payroll batch, ExponentHR performs a diagnostic check to inform you of any critical or warning (non-critical) events that you should review and possibly correct prior to performing final approval of the batch. The Diagnostics tab displays all the critical errors and warnings contained at both the batch and employee level This information may also be viewed by generating the Batch Diagnostics report.

Critical ErrorsCritical Errors

Critical events appear in any failed batches. They must be addressed before the respective payroll batch is made available for approval.

Payroll Batch Diagnostics

Pay date does not allow time for payroll funding. Pay date for the off-cycle batch is not far enough in the future for funding and there is not enough deposit to cover it.

Your pay date is set to Saturday, Sunday, or Holiday. You have set the pay date for an off-cycle to a weekend, bank holiday or company holiday. You must edit the batch settings and identify a new pay date.

One or more employees exist in another pending batch. An employee in the current batch already exists in another pending batch. The other batch must be completed or the employee must be removed from this batch before this batch can be completed.

Pay date is in the past. This could occur if you fail to approve an off-cycle batch until after the pay date. You must reject the batch and edit the pay date. If the batch with the error is part of an off-cycle batch containing multiple EINs, you will have to reject ALL of the batches before adjusting the pay date. If any of the batches were already posted, then you will have to leave the batch with the error in a rejected status and create a new off-cycle batch with the correct pay date.

Voucher Diagnostics

Insufficient cash to pay taxes. There is negative net pay or otherwise insufficient pay to cover tax withholding.

The gross pay is less than zero. The gross pay has negative earnings. Gross pay is negative. This typically happens when negative hours are entered.

Third Party Pay Batch Diagnostics

Net pay <> 0 on 3rd party pay voucher. The net pay on the third party voucher does not equal zero.

ExponentHR calculated an EE tax amount different from the amount collected from the employee. The difference between the employee Social Security Tax or Medicare Tax entered by the user and the amount calculated by ExponentHR differs by more than $0.10.

You can choose to address or disregard the warning messages before approving the payroll batch:

Deductions were reduced because they exceeded gross pay less taxes and reimbursements. The deductions being taken are greater than the check can support and had to be reduced to avoid having negative net pay.

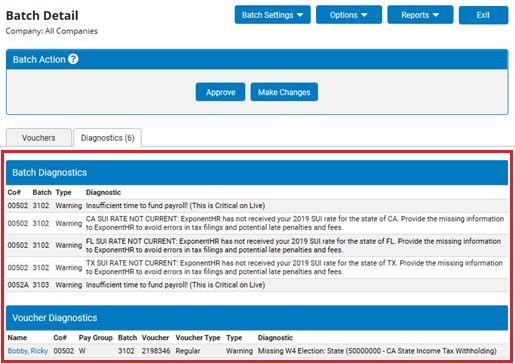

Missing W4 Election (XX) – Local, State, or Federal. Missing W4 record. The Employee’s work or home address triggered tax in a state or locality and the employee record does not contain a valid W4 election for that entity. If you want to change this result, you must first reject the batch. Then create an Employment Change EAN to identify the desired withholding. ExponentHR must then complete the EAN, after which you may resubmit the Batch.

Flat amount retirement contribution on supplemental check. Employee has elected a flat amount retirement contribution amount and it is being applied on a supplemental check.

No SUTA rate exists for this work state: XX. Employee has wages in a state with no SUTA rate defined.

Net pay is over XXXXX. The net pay amount of the voucher exceeds the amount identified in your company setup. You must contact ExponentHR to identify the value for a net pay warning.

Gross pay is over XXXXX. The gross pay amount of the voucher exceeds the amount identified in your company setup. You must contact ExponentHR to identify the value for a gross pay warning.

Total Earnings of X dollars for X hours worked results in an hourly wage of XXX. This is below the federal minimum rate of X.XX or state minimum rate of X.XX. The total pay (minus noncash earnings and reimbursements) / hours worked = a rate less than the higher of Federal minimum wage or work state minimum wage. This warning is typically associated with piece work employees.

EE tax withheld is over the annual limit for [Taxcode] – [TaxDesc]. Employee tax withholding entered by the user plus the YTD Tax Amount is greater than the annual limit for the respective tax code.

EE tax withheld for which no taxable wage base exists [Taxcode] – [TaxDesc]. Employee tax withholding exists for a tax code for which there are no taxable wages entered in the batch for the respective employee.

ExponentHR calculated an EE tax that was not collected by the 3rd party [Taxcode] – [TaxDesc]. ExponentHR returned a tax amount greater than zero on a tax code for which the user entered no tax amount for the respective employee.

ExponentHR calculated an EE tax amount different from the amount collected from the employee. For taxes OTHER THAN Federal or State Withholding, ExponentHR calculated a different amount than what the user entered.

Whenever your payroll activity indicates that you have begun doing business in a new taxing jurisdiction, or when an existing registration is up for renewal, ExponentHR posts a Tax Compliance Notifications, which will appear under the Warnings section of the batch diagnostics. You can choose to proceed with approving the payroll batch when these warnings appear; however, failure to regain compliance with any of these items may result in state penalty and interest fees and/or ExponentHR non-compliance fees:

State Registration. All states require registration with some requiring registration before any tax payments are accepted. Once registered, the resulting assigned Tax Account Number needs to be provided to ExponentHR to ensure timely payments are made and properly posted to the account by the taxing authority. In addition, registration may also be required for some localities, such as in Kentucky, Ohio, and Pennsylvania.

Current State SUI Rate. When a state releases the annual SUI tax rates, a notice is sent to your organization. A copy of the notice needs to be sent to ExponentHR to ensure that proper state unemployment tax amounts are being calculated.

State Power of Attorney. In order to make tax payments on your organization's behalf, some sates require that a Power of Attorney be completed, granting permission for the state to receive funds from ExponentHR. In some cases, the Power of Attorney is also required to obtain authorization to file and pay taxes electronically or to resolve tax issues.

The ExponentHR non-compliance fees are assessed each month after 30-days from when the diagnostics warning first occurred. These fees will reoccur each month until the documentation associated with the diagnostic warnings is provided. However, if you provide ExponentHR with the required documentation, through the Tax Management utility (Wage & Tax > Tax Management), no later than the last Monday of a month, any associated ExponentHR non-compliance fees for that respective month will be avoided.

To view the Diagnostics report:

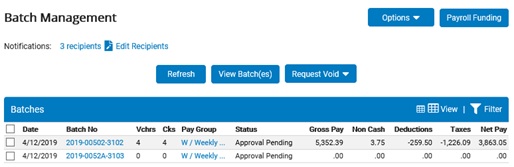

1. On the Management Navigation Menu, click Wage & Tax > Batch ManagementWage & Tax > Batch Management.

The Batch ManagementBatch Management page displays.

2. Select the check box for the batch(es) you want to review.

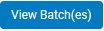

3. Click the View Batch(es)View Batch(es) button.

The Batch DetailBatch Detail page displays, sorted by variance in gross pay from the previous payroll.

4. Click on the DiagnosticsDiagnostics tab to review the batch and voucher-level diagnostic warnings.

Note: You can also click the ReportsReports button and generate the Diagnostics report from the report drop-down list.