You can access several different reports as part of the batch review process.

Payroll Batch ReportsPayroll Batch Reports

Gross-to-Net Register. Provides earnings, deductions, tax, and non-cash totals to show how net pay was calculated for each employee in the batch.

Earnings Code Summary, Deduction Code Summary, EE Tax Code Summary, ER Tax Code Summary, ER Contribution Code Summary. Provides batch totals by code type, with the ability to drill into any specific code (earnings, deductions, employee and employer taxes, and contributions) to see detailed voucher data for that code. This is similar to the Show Summary Total filters, but provides the additional functionality to quickly drill down and print the reports.

Sales Receipt Code Summary. Provides batch totals for sales receipts, with the ability to drill into any specific code to see detailed voucher data for that code.

Retirement Contributions. Provides detailed/consolidated information on all eligible earnings, employee contributions, loan payments, and employer match money contained within each voucher in the batch.

Cost Allocation Report (for clients who use Cost Allocation). Provides detailed/consolidated allocation information for all earnings within the batch. (Cost allocation does not distribute to Deductions/Taxes until the batch is finalized/posted.)

Garnishment Report. Provides detailed/consolidated information on all employee garnishments triggered within the batch.

Voucher Adjustments. Identifies all deductions and non-cash items in the batch that were reduced or eliminated to adjust Net Pay on a voucher to zero.

ACH. Provides detailed/consolidated information on all employee ACH (direct deposit) funding triggered within the batch.

Check Register Report. Allows you to review preliminary check information, including regular as well as supplemental pay, garnishments, and voids, prior to posting the payroll batch.

Shipping/Tracking Information. Provides the detailed shipping information for each separate package of checks associated with a payroll batch. This information includes the number of payroll checks included in the package, the shipping location, shipment method, and tracking number (if applicable).

To view any one of the payroll batch reports:

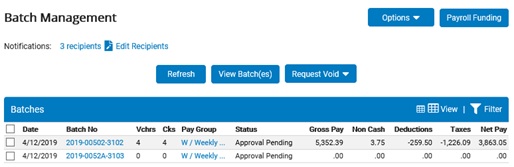

1. On the Management Navigation Menu, click Wage & Tax > Batch ManagementWage & Tax > Batch Management.

The Batch ManagementBatch Management page displays.

2. Select the check box for the batch(es) you want to review.

3. Click the View Batch(es)View Batch(es) button.

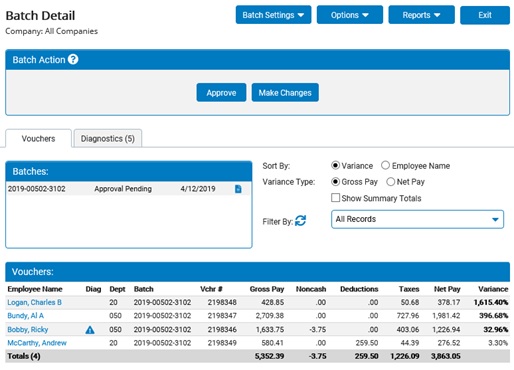

The Batch DetailBatch Detail page displays, sorted by variance in gross pay from the previous payroll.

4. If desirable, use the available filtering option to refine the detail display of the selected batch(es). The filtering applied to the view of the Batch Detail page will automatically be applied to any of the reports generated from the same page.

5. Click the ReportsReports button and select the desired report you want to view from the report drop-down list.