For each employee, the IRS Form W-4 needs to be completed so that the proper Federal withholding elections can be applied. Additionally, some states require a similar state-issued form to be completed to address State withholding elections. Both Federal and State withholding elections are managed through W-4 Withholding Summary page.

Note: The W-4 Withholding Change Request wizard does not open for Paid Contractors since it is not applicable.

You

have just completed your annual tax return and realized that you

have not been withholding enough from each paycheck and therefore

are required to pay an additional $1,500 in taxes with your return.

In order for this not to occur next year, you can edit your W-4

withholding amount to balance your owed taxes at the end of the

tax year. |

To edit your Federal or State W-4 withholding elections:

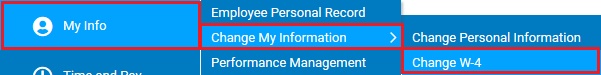

1. On the Menu, click My Info > Change My Information > Change W-4My Info > Change My Information > Change W-4.

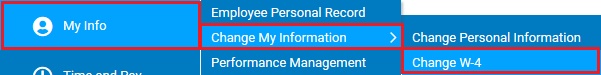

The W-4 Withholding SummaryW-4 Withholding Summary page displays and reflects your current Federal and State election amounts.

2. To edit an existing withholding election, click the EditEdit button next to the respective item.

If wanting to add a new State election (ex. you are now employed in a different state):

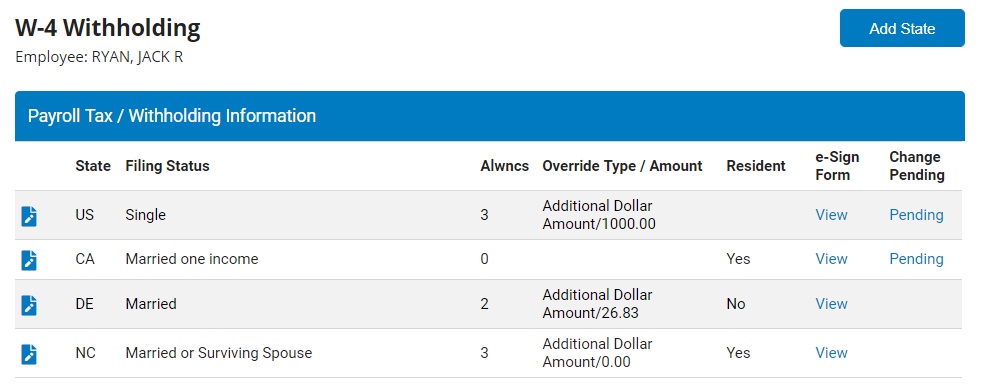

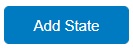

Click the Add StateAdd State button. The Add State WithholdingAdd State Withholding box displays.

Select a state from the StateState drop-down box.

Mark the appropriate radio button, Yes or No, for Are you a ResidentAre you a Resident (of the selected state).

Click the AddAdd button.

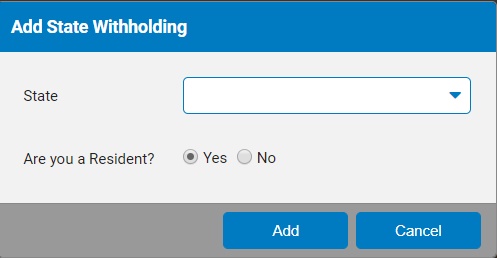

The Tax WithholdingTax Withholding page displays with the fileds associated with the respective form.

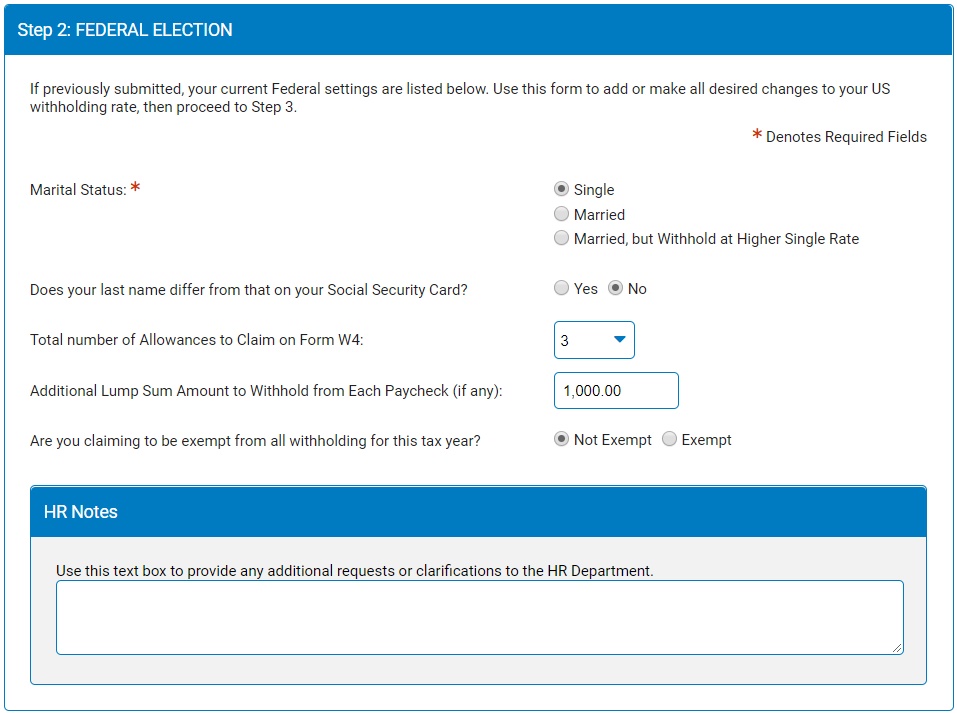

Use the Tax Withholding page to request changes to your payroll withholding and create a personalized copy of your W-4 form. Carefully follow the instructions on this page and complete all applicable steps to ensure that your request is delivered to the payroll department. The steps below follow the IRS Form W-4; however, specific State forms may have alternate fields to fill out.

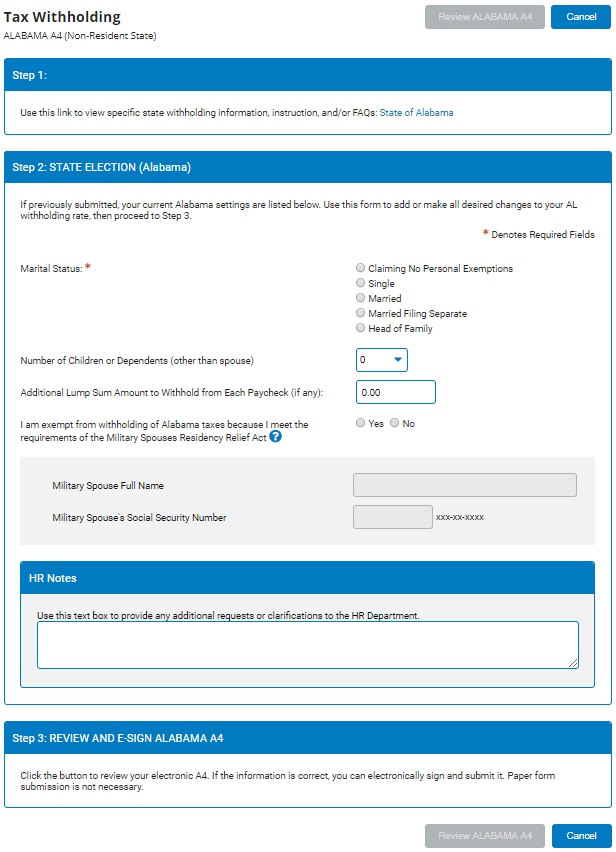

3. If you need assistance computing your W-4 withholding allowances, click the IRS Withholding CalculatorIRS Withholding Calculator link in Step 1 of the change request.

Note: The IRS Withholding Calculator page displays a series of interview questions. When you complete the interview, close the IRS window to return to ExponentHR.

4. Answer the questions in Step 2Step 2 of the change request.

5. Click the Review FEDERAL W-4Review FEDERAL W-4 button to view an electronic version of the form with the values inputted in the prior step.

6. If satisfied with the election changes displayed, click the e-Sign and Submite-Sign and Submit button. This will document your electronic signature/approval of the form and automatically submit a copy to your management team so that it can be applied to future paychecks.

Note: If changes are needed, click the Make ChangesMake Changes button to return to the previous page.