This report provides a summary of all adjustments to retirement plan deferrals and employer matches for a specific employee or for all employees.

To run this report:

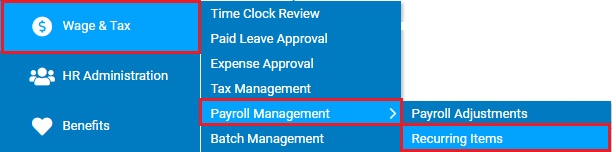

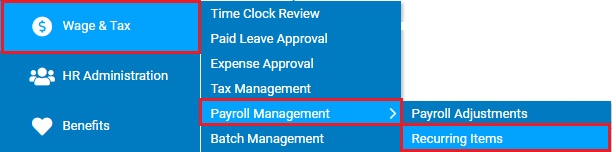

1. On the Menu, click Wage & Tax > Payroll Management > Recurring ItemsWage & Tax > Payroll Management > Recurring Items.

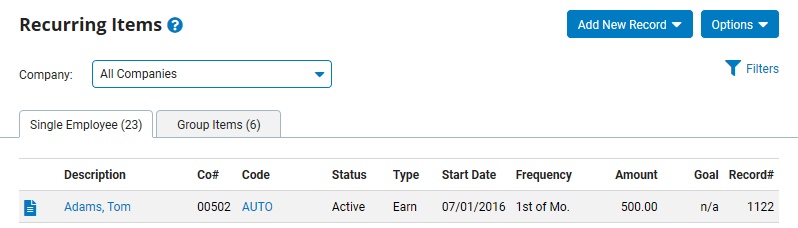

The Recurring ItemsRecurring Items page displays.

2. Click the Options button and select the 401(k) Adjustments Report item.

The 401(k) Adjustments Report401(k) Adjustments Report page displays.

_Adjustments_Report.jpg)

3. Select the desired Format radio button, depending on if you want the output as HTML or an Excel export.

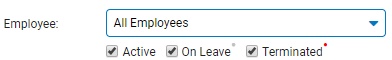

4. If necessary, select a specific employee from the EmployeeEmployee drop-down box to view a 401(k) adjustments report for that employee only.

Note: Leave the field set to All Employees to view a report including all employees at your company.

5. To filter the list by status of the adjustment (active, inactive, completed, or deleted), make a selection in the Status Filter drop-down list.

6. If necessary, configure the Sort By options to control the presentation of the detailed data.

7. If necessary, designate the optional fields you would like included in the report by checking the check box by each optional field in the Additional Fields section of the report.

Checking the Optional Fields check boxes will add/suppress additional columns from the formatted results.

8. Click the Generate ReportGenerate Report button.

Result: The report you selected displays in a new window with the options you selected.

Notes:

You may print the report by clicking the Print button.

You may close the report by clicking the Close button.

Related Help Topics: