Through adding a deduction in the Recurring Items utility, you can perform bottom-line adjustments (positive or negative) to previously applied retirement plan deductions and employer match calculations.

Notes:

The amount(s) included in the adjustment record bypass all system limits and caps related to your retirement plan deferral and match calculation.

Adjustments made to an employee deferral will not automatically trigger a higher or lower employer match amount. You must specify adjustments to employer match.

A

401(k) EAN was not completed for one of your new employees prior

to payroll submission, resulting in no deferral on the employee’s

check. On the employee’s next scheduled payroll, you need to insert

the missing deferral amount and associated employer match for

that employee. Use the retirement plan adjustment feature in the

Recurring Items utility to add each specific adjustment amount

for employee deferral and employer match. |

To make adjustments to retirement plan deferrals:

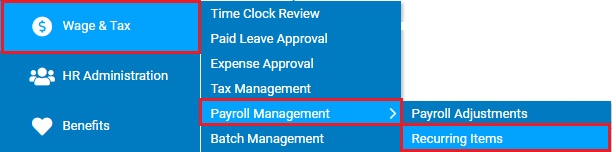

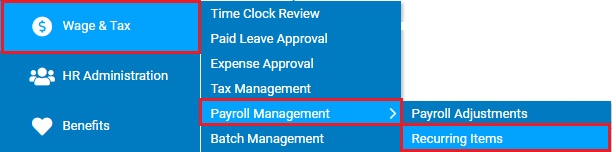

1. On the Management Navigation Menu, click Wage & Tax > Payroll Management > Recurring ItemsWage & Tax > Payroll Management > Recurring Items.

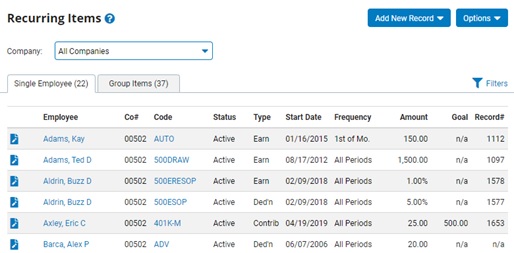

The Recurring ItemsRecurring Items page displays.

2. When creating a deduction adjustment, you have the option to create an adjustment for a single employee or an adjustment to be applied to a group of employees.

Click on the Single Employee or Group Items tab to create the respective type of deduction adjustment.

3. Click the Add New RecordAdd New Record button and select the Deductions option.

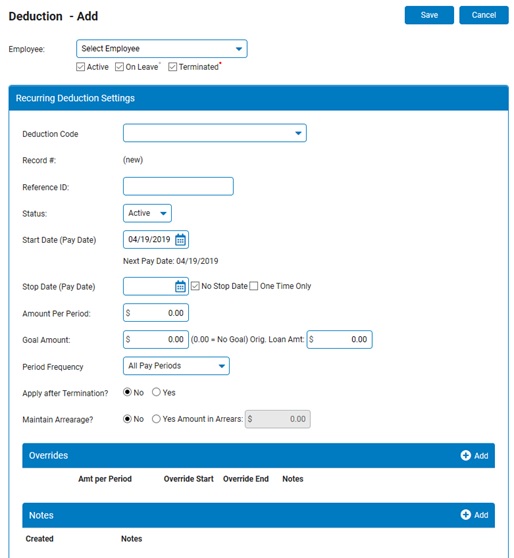

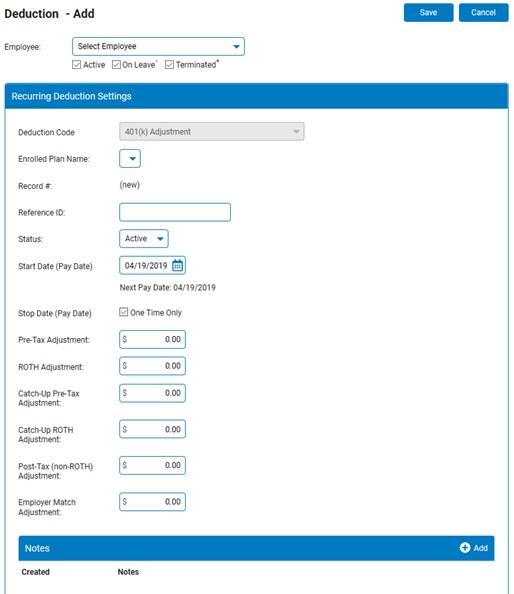

The Deduction - AddDeduction - Add page displays.

4. Select the employee to which you would like to apply the deduction adjustment from the Employee drop-down box. If creating a Group Recurring Item, click the Select Employees button to manage the list of employees that will be part of the recurring group.

5. Select the 401(k) Adjustment deduction type from the Deduction Code drop-down box.

The Deduction - AddDeduction - Add page updates.

Note: If your organization offers a 403(b) plan, select 403(b) Adjustment as the Deduction Code.

6. If necessary, select the plan for which you want to make adjustments in the Enrolled Plan Name drop-down list.

7. If available, type an identification number in the Reference ID text box.

8. Select whether the deduction is active or inactive from the Status drop-down box.

9. Enter the payroll date for the adjustment in the Start Date (Pay Date) field.

The amount you entered will be added to or subtracted from the employee's paycheck on the date you entered.

Notes:

This date must be a valid pay date at your company.

The next scheduled company pay date is listed below the field.

10. Enter positive or negative amounts to apply to the employee's normal deferral amount.

The cumulative total of all amounts is applied as a bottom-line adjustment to previously applied retirement plan deductions.

11. Enter positive or negative amounts to apply to the normal employer match in the Employer Match Adjustment text box.

12. Enter any notes related to the earnings adjustment in the Notes text box by clicking the Add button.

13. When you have entered all necessary changes, click the Save button.

Result: The new deduction is now visible on the Recurring Items page, and will be applied to the paycheck you specified.

Related Help Topics

Setting Up 401(k) Loan Deductions