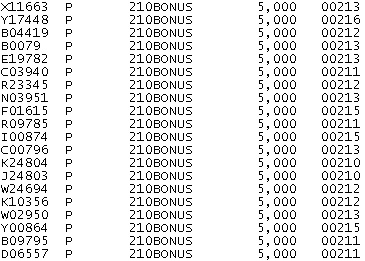

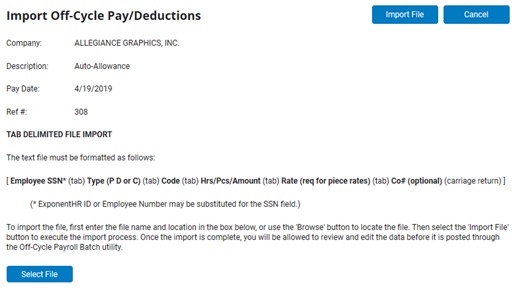

When setting up an off-cycle pay batch, you can choose to import the data from a text file, which must be formatted as follows:

Note: You cannot import cost allocation information.

To import off-cycle pay, deductions, or employer contributions from a file:

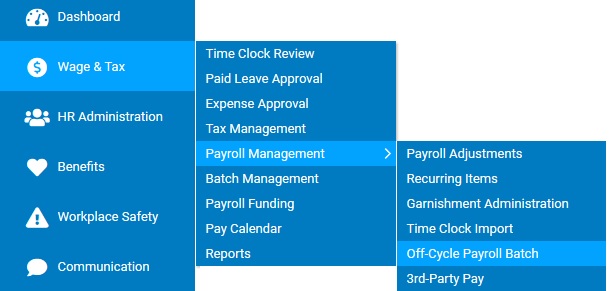

1. On the Management Navigation Menu, click WAGE & TAX > Payroll Management > Off-Cycle Payroll BatchWAGE & TAX > Payroll Management > Off-Cycle Payroll Batch.

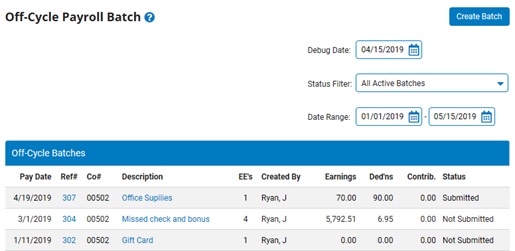

The Off-Cycle Payroll BatchOff-Cycle Payroll Batch page displays, with any pending off-cycle payroll batches.

2. Click the Create BatchCreate Batch button.

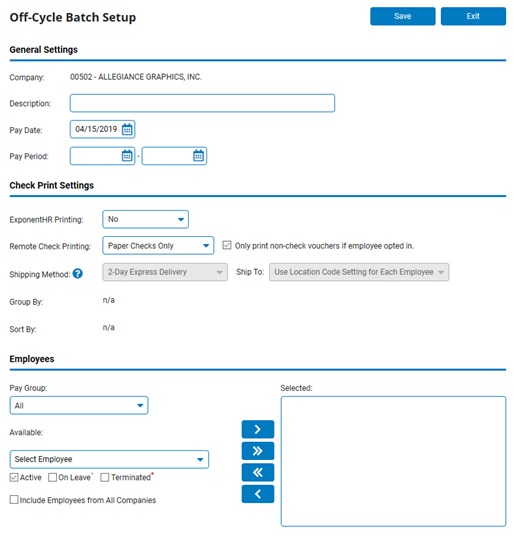

The Off-Cycle Batch SetupOff-Cycle Batch Setup page displays.

3. Set up the parameters for the off-cycle batch. See the Related Help Topic.

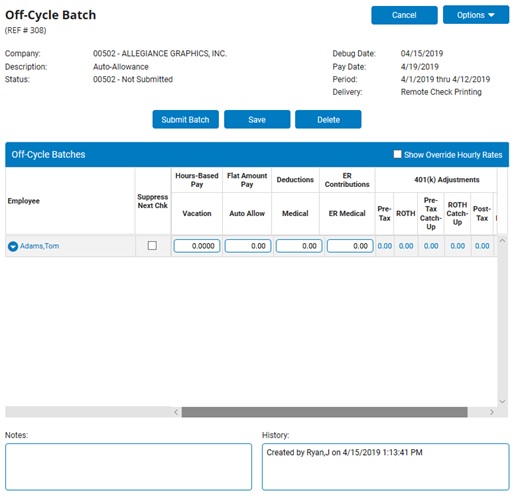

The Off-Cycle BatchOff-Cycle Batch page displays.

4. Click OptionsOptions in the top right corner of the page, and then click Data File Import.

A Confirmation page displays.

5. Click the OK button.

The Import Off-Cycle Pay/DeductionsImport Off-Cycle Pay/Deductions page displays.

Note: Choosing to import data from a file will override any earnings, deductions, or contributions already entered within the Off-Cycle Batch.

6. Click the Select FileSelect File button to find the file you want to import.

7. Click the Import FileImport File button.

Result: The Off-Cycle Batch page displays, with all valid data that was imported from the import file.

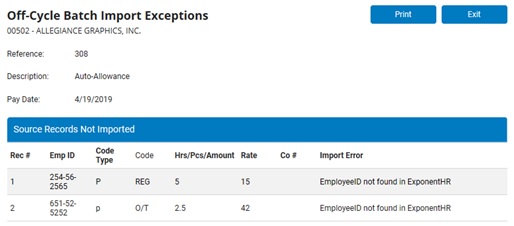

Note: If there was a problem with any part of the import, the Off-Cycle Batch Import ExceptionsOff-Cycle Batch Import Exceptions page displays.

The Employees Added to the Batch section lists any employees found in the import file that were not already in the batch.

The Payroll Codes Added to the Batch section lists any payroll codes found in the import file that were not already in the batch.

The Source Records Not Imported section lists any records in the import file that are invalid and provides the reason they were not imported.

Click the Exit button to return to the Off-Cycle Batch page.

Related Help Topics