The minimum wage gross-up calculation is applied to an employee's effective rate when they receive less than the minimum wage and the employer is expected to make up the difference. The calculation is normally applied to tipped employees as well as piecework-only employees; however, you can suppress it by employee in any open pay period.

Note: If you want to suppress the minimum wage gross-up calculation in all pay periods for a specific employee (tipped or piecework-pay only) or override the Federal/State minimum wage rate with an alternate rate (such as a locality or job function minimum wage rate), you can make the change by submitting a Change Employment Information or Job Change EAN. See the Related Help Topics.

To suppress the gross-up calculation for the open pay period:

1. On the Management Navigation Menu, click Wage & Tax > Time Clock ReviewWage & Tax > Time Clock Review and select the pay schedule.

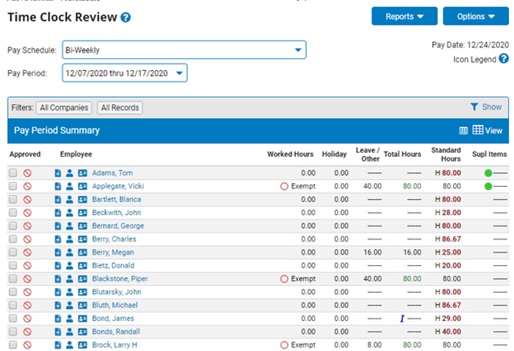

The Time Clock ReviewTime Clock Review page displays.

2. Click the Options button and select the Suppress Min. Wage Gross-up item.

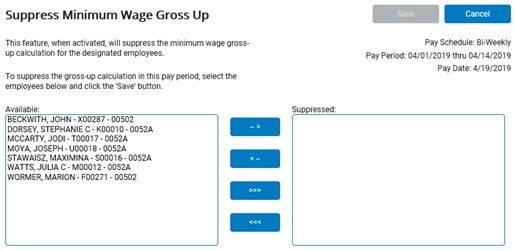

The Suppress Minimum Wage Gross UpSuppress Minimum Wage Gross Up page displays. Only employees with Use Minimum Wage Gross Up set to Yes appear in the list.

3. Select the employee(s) for whom you want to suppress the gross-up, and then click the arrow button to move the employees to the Selected list.

4. Click the Save button.

Result: A red arrowred arrow appears next to the employee on the Time Clock Review page, indicating that the employee's average hourly rate is below the applicable minimum wage but the minimum wage gross-up calculation has been suppressed. (A black arrow appears for any employee to whom the minimum wage gross-up was applied.)

![]()

Related Help Topics