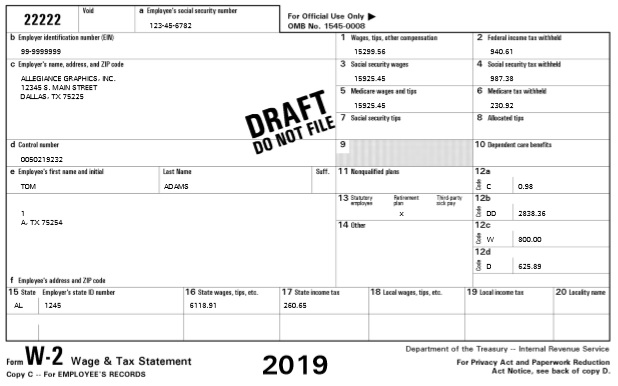

You can see a draft of an employee's W-2 (or a contractor's Form 1099) at any time using the Year-End Information utility. After you have approved the data at year end and it has been processed, you can see the official tax form that the employee will receive.

Note: Employees can view/print a replacement form on the Payroll Summary page in the Personal View. If the data has not been approved and finalized by ExponentHR, the form will be marked as a DRAFT and restricted from employee view.

To view an employee's W-2 or a contractor's 1099 data:

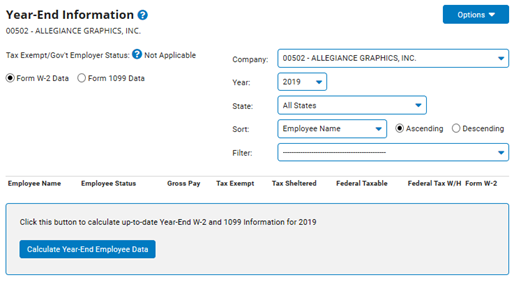

1. On the Management Navigation Menu, click Wage & Tax > Payroll Management > Year-End InformationWage & Tax > Payroll Management > Year-End Information.

The Year-End InformationYear-End Information page displays.

2. For Form 1099 data (instead of W-2 data), click the radio button in the upper left corner.

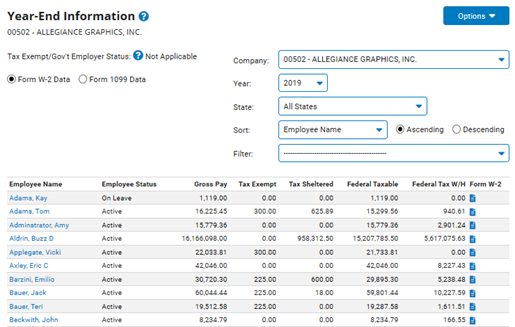

3. If necessary, click the Calculate Year-End Employee Data button.

The Year-End InformationYear-End Information page updates.

4. Click the View button in the row of the employee whose W-2/1099 data you want to see.

A draft of the employee's W-2draft of the employee's W-2 displays.

Related Help Topics

Reviewing and Approving W-2/1099 Data