You use the Year-End Information utility to review and electronically approve Form W-2/1099 data at year end, which triggers the processing and mailing of the tax forms.

Notes:

If any payroll codes contain missing or invalid W-2 box/code information, you must update the payroll codes with the correct information in Codes Management before you can approve the data for printing.

If your company has multiple EINs, you must repeat the review and approval process for each company separately.

To review and approve W-2/1099 data:

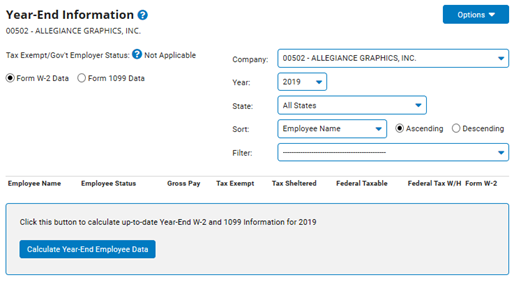

1. On the Management Navigation Menu, click Wage & Tax > Payroll Management > Year-End InformationWage & Tax > Payroll Management > Year-End Information.

The Year-End InformationYear-End Information page displays.

2. For Form 1099 data (instead of W-2 data), click the applicable radio button

3. Click the Calculate Year-End Employee Data button.

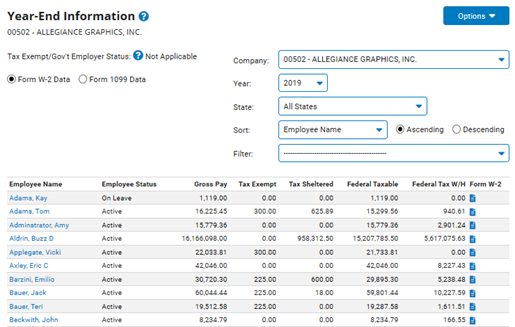

The Year-End InformationYear-End Information page updates.

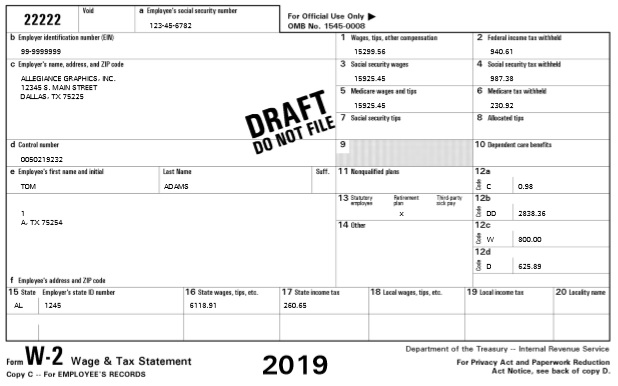

4. Click the View button in the row of the employee whose W-2/1099 data you want to review.

A draft of the employee's W-2draft of the employee's W-2 displays.

5. On the Year-End Information page, select the check box next to each employee/contractor whom you want to mark as reviewed.

Note: Click the Select All button to check all employees listed in the current view.

6. When all employees/contractors have been reviewed, click the Approve button to submit all W-2/1099 data for printing.

Notes:

If you have reviewed some, but not all employees, click the Save button to save the reviewed status of the employees and complete the review process at a later time. When you re-open the Year-End Information utility, you will be prompted to recalculate the year-end employee data. Any employee marked as reviewed from a previous session will remain checked unless the re-calculation results in a material change to the form/data.

You can click the employee name link at any time to open a modified Payroll Register report with employee detail for the entire year.

Related Help Topics

Viewing an Employee's W-2/1099 Data

Adding Outside Pay for a 1099 Contractor