The W-4 Withholding report provides a consolidated view of all existing employee W-4 elections. The report lists all Federal, State, and Local tax authorities and includes overrides and adjustments.

To run this report:

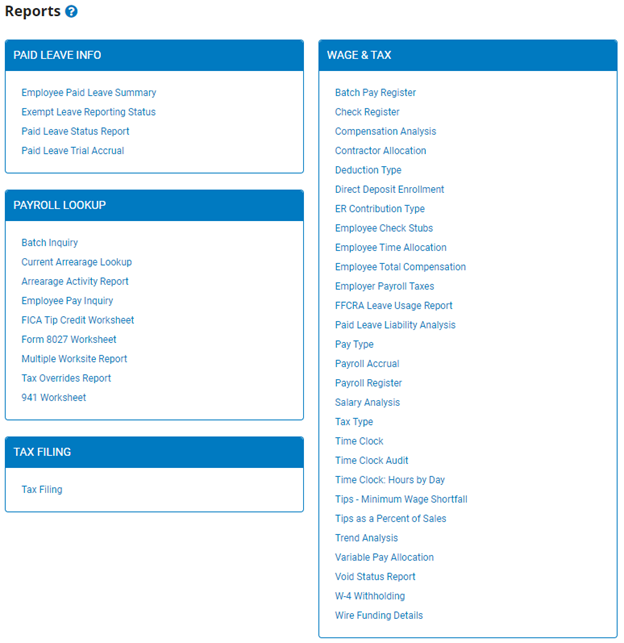

1. On the Menu, click Wage & Tax > ReportsWage & Tax > Reports.

The reports availablereports available menu displays.

2. Click the W-4 Withholding link.

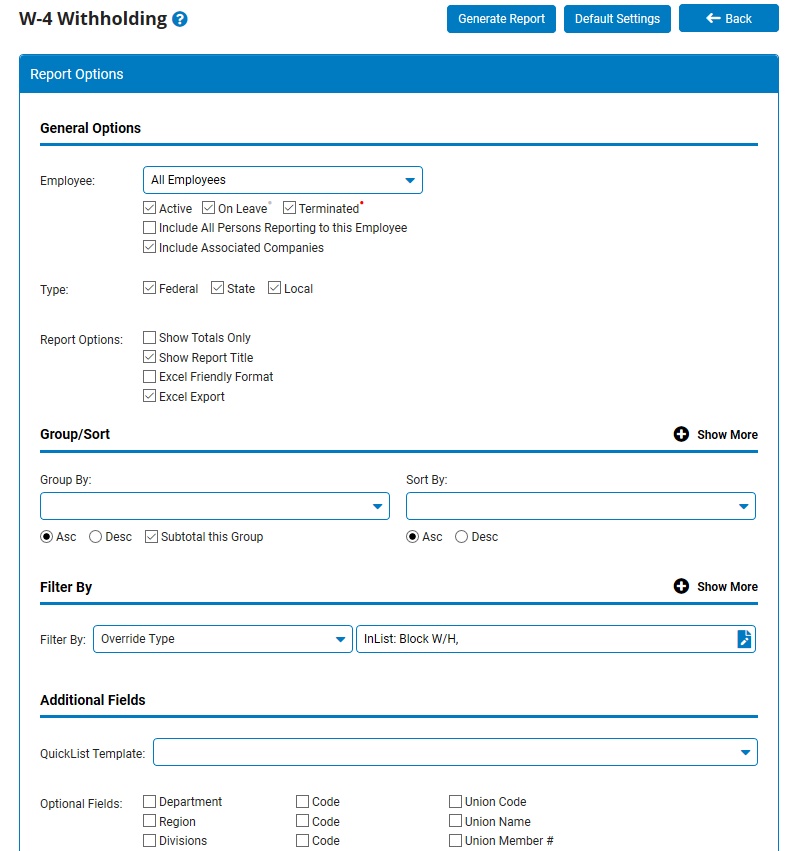

The W-4 WithholdingW-4 Withholding page displays.

Note: This same report may also be accesses through the Tax Reports drop-down list in the Tax Management utility.

3. If necessary, select a specific employee from the Employee drop-down box to view the report for that employee only.

Notes:

Leave the field set to All Employees to view a report including all employees at your company.

You can filter the list by active, on leave, and terminated employees.

You can choose to include all employees who report to the selected employee.

If you have multiple companies under one parent company, you can choose to include all companies.

4. To format the report by grouping, sorting, or filtering the results, see the Related Help Topics.

5. Click the Generate Report button.

Result: The report you selected displays in a new window with the options you selected.

Notes:

You may print the report by clicking the Print button.

You may close the report by clicking the Close button.

Related Help Topics: