Using the Year-End Information utility, you can allocate any compensation that may have been paid to a contractor in the designated year outside of the ExponentHR system. The amount entered will be added to all pay incurred in ExponentHR for the contractor when the Form 1099 is generated.

Note: You can also add outside pay through the Consultant/Contractor Access EAN. See the Related Help Topic.

To add outside pay for a 1099 contractor:

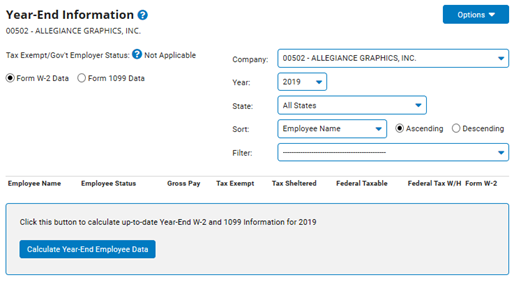

1. On the Management Navigation Menu, click Wage & Tax > Payroll Management > Year-End InformationWage & Tax > Payroll Management > Year-End Information.

The Year-End InformationYear-End Information page displays.

2. Click the Form 1099 Data radio button.

3. If necessary, click the Calculate Year-End Employee Data button.

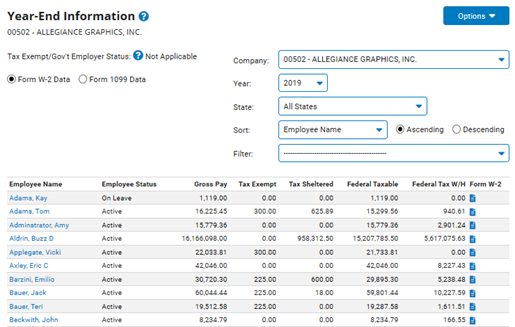

The Year-End InformationYear-End Information page updates.

4. Click the Outside 1099 Comp link in the row of the employee for whom you want to add outside pay.

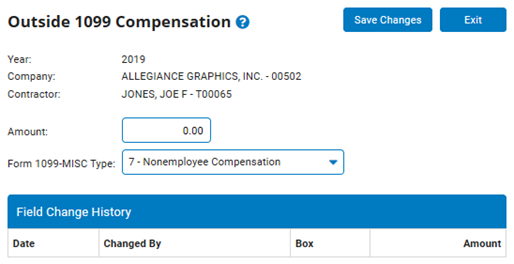

The Outside 1099 CompensationOutside 1099 Compensation page displays.

5. Type the amount of outside compensation.

6. Select which box on the Form 1099 where the outside compensation should be reported.

7. Click the Save Changes button.

Related Help Topics

Reviewing and Approving W-2/1099 Data

Printing All W-2/1099-MISC Forms