Employees make 401(k) elections through your plan provider. However, the deferral election must also be set up in ExponentHR through a 401(k) Deduction EAN in order to trigger the appropriate payroll deductions.

In some cases, based on company setup rules and approval by third party providers, employees can make changes to their retirement plan deferrals themselves through a 401(k) EAN.

Note: Employee 401(k) loan repayments should be set up through the Recurring Items utility in Payroll Management. See the Related Help Topic.

Note on Completion: After the EAN is submitted to ExponentHR, it will immediately complete. If the effective date is in the future, the new deferral election(s) will apply to any pay dates that occur on or after the designated effective date. Only one future 401(k) election may be present in the system at one time. If you process another 401(k) EAN for the same employee before the effective date of the prior EAN has been reached, the new deferral election(s) and the new effective date will overwrite the prior EAN.

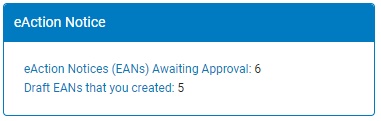

To check the expected completion date for the EAN, refer to the eAction Notice (EAN) Details page for the EAN. See the Related Help Topic.

To edit an employee's retirement deferral contribution election:

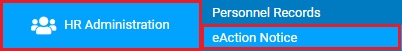

1. On the Menu, click HR Administration > eAction NoticeHR Administration > eAction Notice.

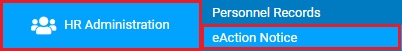

The eAction Notice (EAN) SummaryeAction Notice (EAN) Summary page displays.

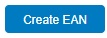

2. Click the Create EANCreate EAN button.

The Create New EAN(s)Create New EAN(s) window displays.

3. Select the employee whose 401(k) deductions you want to change from the Employee drop-down box.

4. Select the 401(k) Deductions EAN from the EAN type selection box and click the Create EANCreate EAN button.

The 401(k) Deductions401(k) Deductions page for the employee you selected displays in a new window.

5. Designate whether or not the EAN will be visible to the employee from the EAN Visible to EmployeeEAN Visible to Employee check box.

Note: If you check the box, the employee may see that you submitted a change to their 401(k) information.

6. Select whether the employee is a Key Employee or Highly Compensated Employee in the General Information area.

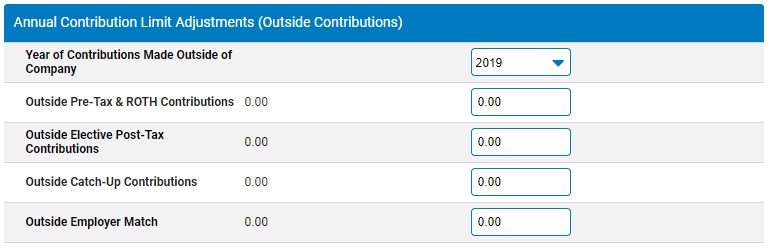

7. If the employee made contributions to a qualified retirement plan while working with another employer or subsidiary, select the year in the Year of Contributions Made Outside of Company drop-down box.

After you select the year, more fieldsmore fields display in the Annual Contribution Limit Adjustments (Outside Contributions) area for you to complete.

8. Enter the date the changes to the employee's 401(k) deductions will take effect in the Effective Date for Election Changes text box.

Note: You can override an employee's eligibility in a selected retirement plan. See the Related Help Topics.

9. Complete the fields in the Retirement Plan Deferral Elections - Regular Payroll area.

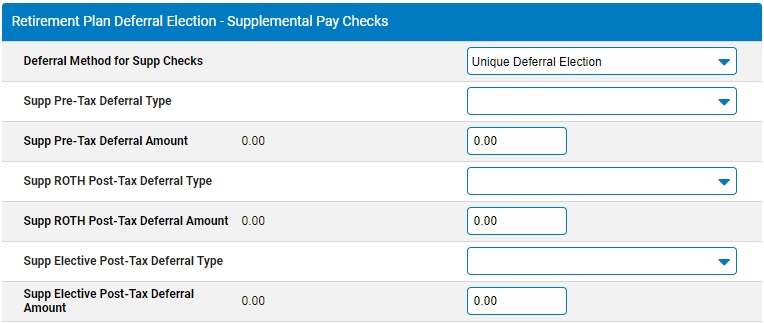

10. If the deferral method for supplemental checks is not the same as for regular payroll, select the option in the Deferral Method for Supp Checks drop-down box.

If you select Unique Deferral Election, more fieldsmore fields display for you to complete.

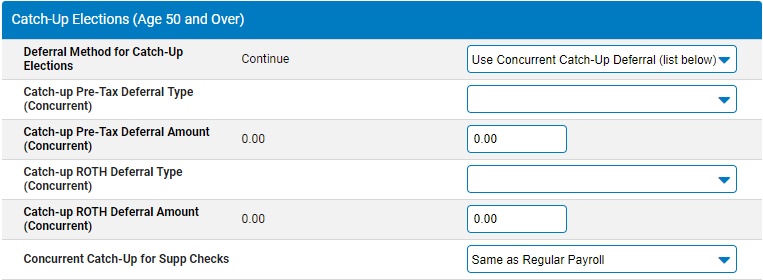

11. If the employee turns 50 during the plan year, complete the fields in the Catch-Up Elections (Age 50 or Over) area.

If you select Use Concurrent Catch-Up Deferral, more fieldsmore fields display for you to complete.

12. Enter any notes related to the EAN in the EAN Notes text box.

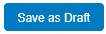

13. Click the Save as DraftSave as Draft button at the top or bottom of the page to keep the requested change in a drafted status so that it may be edited and submitted for completion at a later time.

Note: When an EAN is put in a drafted status, a Draft EAN NoticeDraft EAN Notice with a link to the unsubmitted EAN is provided on the ExponentHR Dashboard.

14. After entering all necessary changes to the 401(k) Changes EAN, click the Submit button to submit it for approval.

Result: The EAN you just completed is now visible on the eAction Notice (EAN) Summary page. An HR administrator must approve the EAN and submit it to ExponentHR for completion. After the EAN is completed, the changes you made to the employee's 401(k) are implemented in ExponentHR.

Note: If you need multiple managers to review this EAN before you submit it, you may re-route the EAN. See Related Help Topics for more information.

Related Help Topics:

Overriding Retirement Plan Eligibility

Setting Up 401(k) Loan Repayment

Checking the Expected Completion of an EAN

Demonstration

For additional information on this topic, click on the link below to view a demonstration.

401(k) Deduction EAN