Typically, an employee's Federal W-4 withholding elections are set up during new hire enrollment, through a New Hire EAN. The employee can make changes through a W-4 Withholding Change Request.

In addition, managers can make changes to Federal W-4 withholding elections on behalf of their employees. For example, they can change their filing status and number of allowances, as well as the preferred tax treatment of any supplemental income. You submit a Change Employment Information EAN to make the change.

Note on Completion: After the EAN is approved for completion, it will immediately complete unless:

The employee's FICA Exempt status is changing to Yes.

The employee's last hire date, employment type, pay method, OT override, or any W-4 field is changing or the FICA Exempt status is changing to No, and the current date is during the Processing Period (or after the Pay Period ends if paid in arrears).

An earlier EAN for the same employee is pending.

To check the expected completion date for the EAN, refer to the eAction Notice (EAN) Details page for the EAN. See the Related Help Topic.

To change an employee's W-4 withholding:

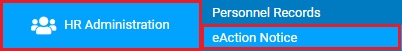

1. On the Menu, click HR Administration > eAction NoticeHR Administration > eAction Notice.

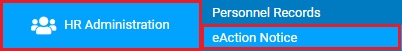

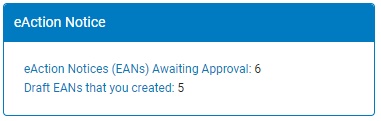

The eAction Notice (EAN) SummaryeAction Notice (EAN) Summary page displays.

2. Click the Create EANCreate EAN button.

The Create New EAN(s)Create New EAN(s) window displays.

3. Select the employee for which you would like to change employment information from the Employee drop-down box.

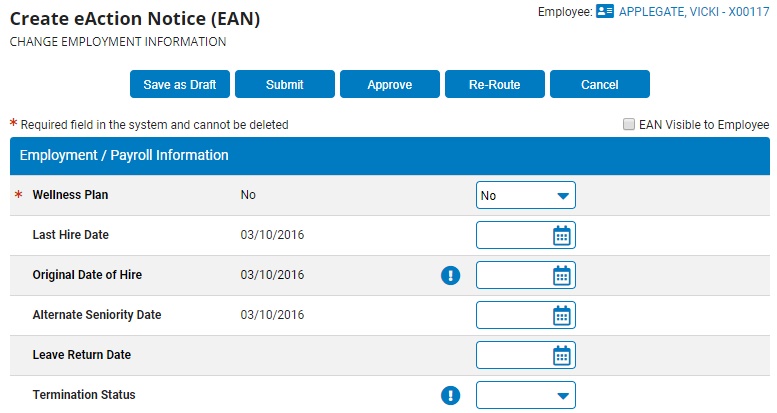

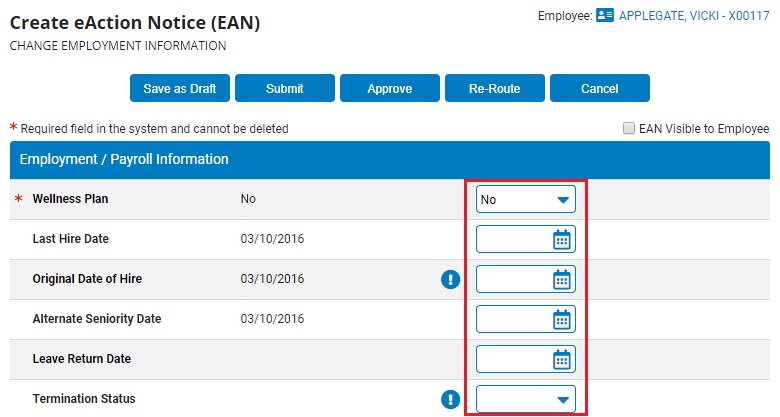

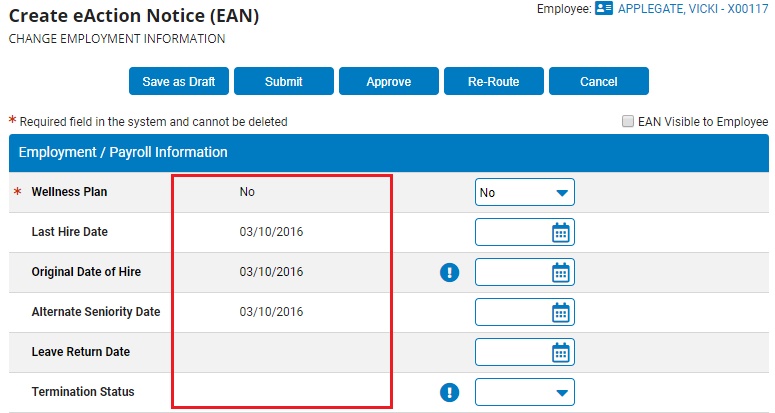

4. Select the Change Employment Information EAN from the EAN type selection box and click the Create EANCreate EAN button.

The Change Employment InformationChange Employment Information page for the employee you selected displays in a new window.

Notes:

In the Employment/Payroll Information section, the left-most columnleft-most column contains the employee's current information and new information is entered in the appropriate boxes in the right-most columnright-most column.

Only enter updated information into fields you wish to change.

To remove an item and leave it empty, enter an asterisk (*) in the input field or select n/a from the drop-down box.

To clear a date field, enter 12/31/1900.

If there is an Action RequiredAction Required button next to any field that you want to edit, click it to view the required actions and supplemental instructions.

5. In the W-4 Fed Allowances, enter the employee's federal tax filing status by selecting options from the Filing Status and Allowances drop-down boxes.

6. If the employee has any additions or deductions to their taxes, in the W-4 Override Type area, select it from the Type drop-down box and enter the amount (in dollars) of the change in the Amount text box.

7. In the Supp Tax Treatment area, select the tax treatment of any supplemental income for the employee in the Type drop-down box.

You can choose to use the tax table (to be taxed at the same rate as regular earnings), specify a different fixed rate flat amount or percentage (usually 25% for the federal supplemental tax rate), or suppress federal withholding tax altogether. If you select to add/override the rate with a flat amount or percentage, enter the amount in the Amount text box.

8. Select if the employee should receive non-resident alien tax treatment in the Non-Resident Alien drop-down box.

9. Select the employee's advance Earned Income Credit status from the EIC Filing Status drop-down box.

10. Select Yes in the W-2: Statutory Employee drop-down box to check the associated Box 13 check box in the employee's W-2.

11. In the W-2: Retirement Plan drop-down box, specify if the Box 13 check box on the employee's W-2 should be checked (Force), not checked (Suppress), or checked only if the employee has deductions or employer contributions that are tied to specific code types (Determine Via Payroll Data).

12. Enter any notes related to the EAN in the EAN Notes text box.

13. Click the Save as DraftSave as Draft button at the top or bottom of the page to keep the requested change in a drafted status so that it may be edited and submitted for completion at a later time.

Note: When an EAN is put in a drafted status, a Draft EAN NoticeDraft EAN Notice with a link to the unsubmitted EAN is provided on the ExponentHR Dashboard.

14. After entering all necessary changes to employment information, click the Submit button to submit the EAN for approval.

Result: The EAN you just submitted is now visible on the eAction Notice (EAN) Summary page. The EAN must be approved by an appropriate person with rights in order for the change to be completed.

Note: If you need multiple managers to review this EAN before you submit it, you may re-route the EAN. See Related Help Topics for more information.

Related Help Topics:

Change Employment Information EAN

Adding/Editing State Withholding

Setting Up Additional Local Withholding

Setting Up School District Tax Withholding