An employee's home locality for tax purposes is based on their home address, which is entered during the new hire enrollment process (through a New Hire EAN). Similarly, the employee's work locality for tax purposes is based on the work location assigned to them. If the home or work locality needs to be somewhere other than their home address or work location, you can set up an override. You submit a Change Employment Information EAN to make the change.

Employees with a work location override cannot cost allocate hours or other pay between multiple work locations.

An employee was sent to a region for an extended time because he is working at a client office. He is not working at any company-defined work location, so his home/work locality needs to be assigned for tax purposes.

Important: Use caution when making any home/work locality overrides. This can have a significant impact on the employee's taxation.

Note on Completion: After the EAN is submitted to ExponentHR, it will immediately complete unless:

The employee's FICA Exempt status is changing to Yes.

The employee's last hire date, employment type, pay method, OT override, or any W-4 field is changing or the FICA Exempt status is changing to No, and the current date is during the Processing Period (or after the Pay Period ends if paid in arrears).

An earlier EAN for the same employee is pending.

To check the expected completion date for the EAN, refer to the eAction Notice (EAN) Details page for the EAN. See the Related Help Topic.

To override an employee's home or work locality:

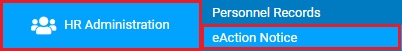

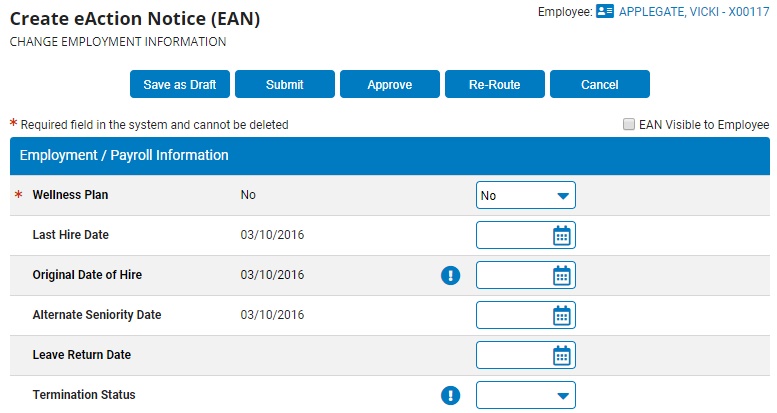

1. On the Menu, click HR Administration > eAction NoticeHR Administration > eAction Notice.

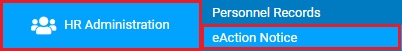

The eAction Notice (EAN) SummaryeAction Notice (EAN) Summary page displays.

2. Click the Create EANCreate EAN button.

The Create New EAN(s)Create New EAN(s) window displays.

3. Select the employee for whom you would like to override the locality in the Employee drop-down box.

4. Select the Change Employment Information EAN from the EAN type selection box and click the Create EAN button.

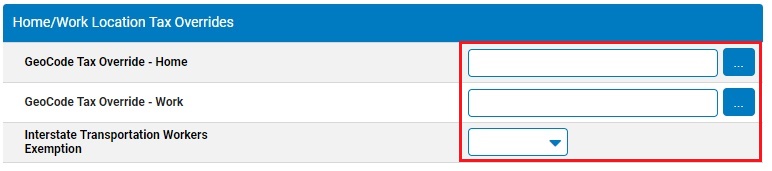

The Change Employment InformationChange Employment Information page for the employee you selected displays in a new window. Scroll down to see the Home/Work Location Tax OverridesHome/Work Location Tax Overrides area.

5. In the Home/Work Location Tax Overrides area, select an override for the employee's home or work locality.

Override home localityOverride home locality

1. Click the Select button by GeoCode Tax Override - Home.

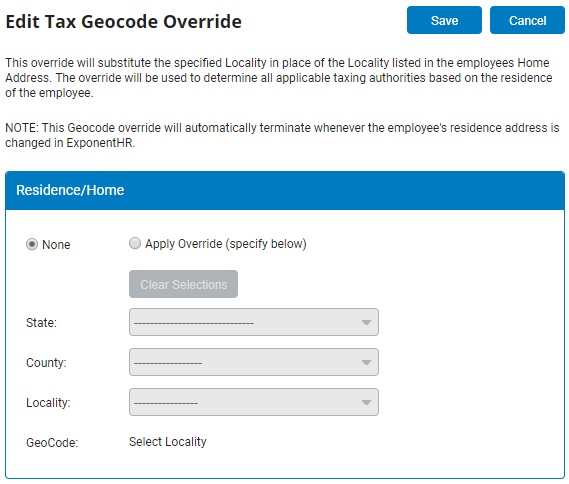

The Edit Tax GeoCode Override - Residence/HomeEdit Tax GeoCode Override - Residence/Home page displays.

2. Click the Apply Override radio button.

3. Select the state, county, and locality from the drop-down boxes.

The associated GeoCode displays.

4. Click the Save button.

Note: This override will automatically end if the employee's

residence address is changed in ExponentHR.

Override work localityOverride work locality

1. Click the Select button by GeoCode Tax Override - Work.

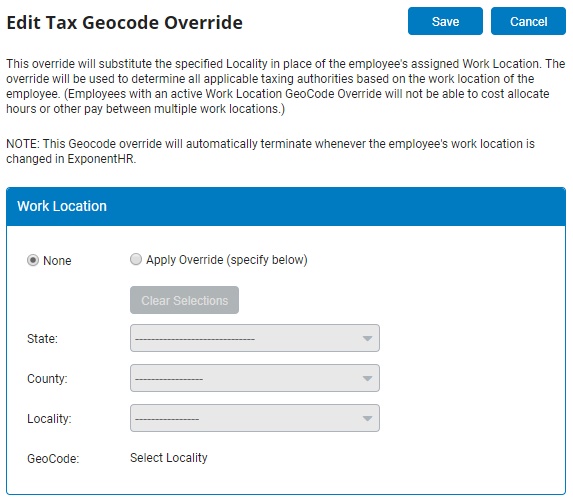

The Edit Tax GeoCode Override - Work LocationEdit Tax GeoCode Override - Work Location page displays.

2. Click the Apply Override radio button.

3. Select the state, county, and locality from the drop-down boxes.

The associated GeoCode displays.

4. Click the Save button.

Note: This override will automatically end if the employee's

work location is changed in ExponentHR.

Note: When an employee moves or is assigned to a new work location, the override is automatically deleted and the new GeoCode is used.

6. Enter any notes related to the EAN in the EAN Notes text box.

7. Click the Save as DraftSave as Draft button at the top or bottom of the page to keep the requested change in a drafted status so that it may be edited and submitted for completion at a later time.

![]()

Note: When an EAN is put in a drafted status, a Draft EAN NoticeDraft EAN Notice with a link to the unsubmitted EAN is provided on the ExponentHR Welcome Page.

![]()

8. After entering all necessary changes to employment information, click the Submit button to submit the EAN for approval.

Result: The EAN you just completed is now visible on the eAction Notice (EAN) Summary page. An HR administrator must approve the EAN and submit it to ExponentHR for completion.

Notes:

You may also click the Save button to save your changes to the EAN without submitting it.

If you need multiple managers to review this EAN before you submit it, you may re-route the EAN. See Related Help Topics for more information.

Related Help Topics:

Change Employment Information EAN

Adding/Editing State Withholding

Setting Up Additional Local Withholding

Setting Up School District Tax Withholding