This report provides information needed to complete lines 1-3 of Form 8846: Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips. It shows the tips (beyond the portion required to bring the employee's hourly wage to minimum wage) on which the employer paid social security and Medicare taxes.

To run this report:

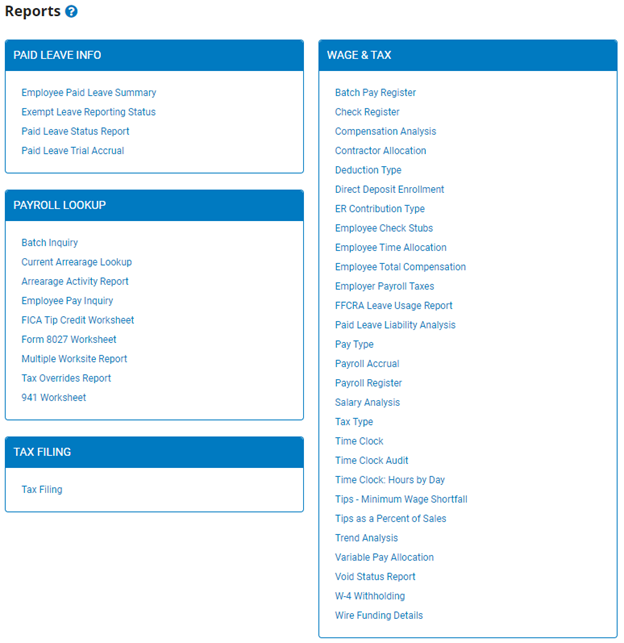

1. On the Menu, click Wage & Tax > ReportsWage & Tax > Reports.

The reports availablereports available menu will display.

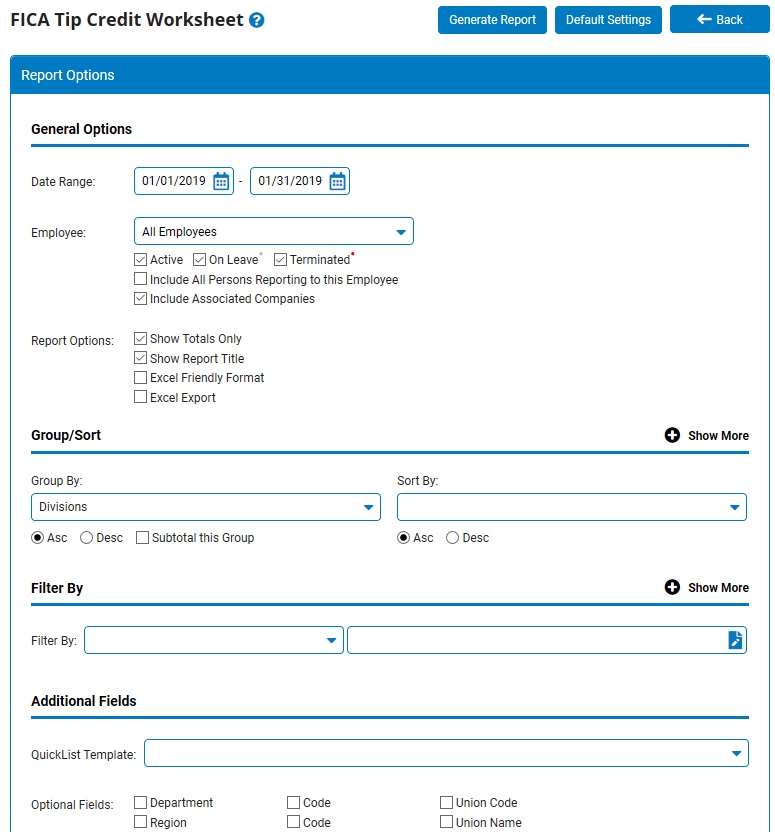

2. Click the FICA Tip Credit Worksheet link.

The FICA Tip Credit WorksheetFICA Tip Credit Worksheet page displays.

Note: This same report may also be accessed through the Tax Reports drop-down list in the Tax Management utility.

3. Enter the start and stop dates in the Pay Date Range fields.

4. If necessary, select a specific employee from the Employee drop-down box to view tip credits for that employee only.

Note: Leave the field set to All Employees to view a report including all employees at your company.

5. To format the report by grouping, sorting, or filtering the results, see the Related Help Topics.

6. Click the Generate Report button.

Result: The report you selected displays in a new window with the options you selected. The report results include the FICA Tip Credit Minimum Wage -- the applicable rates used for the minimum wage and their effective dates.

Notes:

You may print the report by clicking the Print button.

You may close the report by clicking the Close button.

Related Help Topics:

Generating and Formatting a Report

Generating a Report Using a Template