This report helps in calculating minimum wage gross-up (in arrears) based on data from previous pay periods. It shows hours worked at a rate below minimum wage, base hourly wages for those hours, unit based pay included in the minimum wage gross up calculation, reported tips, and allocated tips per pay period for selected employees for a specified pay date range.

Note: If you are calculating minimum wage gross-up manually using this report, you may need to disable the automatic calculation, which is normally applied to all tipped and piecework employees. See the Related Help Topic.

To run this report:

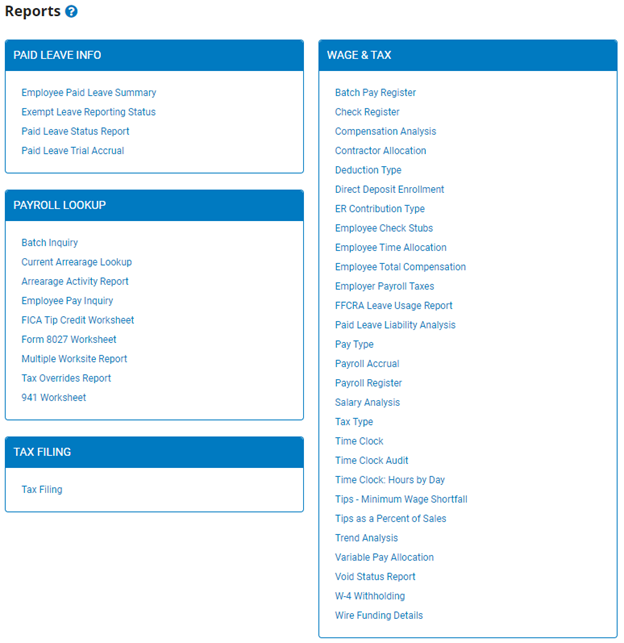

1. On the Menu, click Wage & Tax > ReportsWage & Tax > Reports.

The reports availablereports available menu displays.

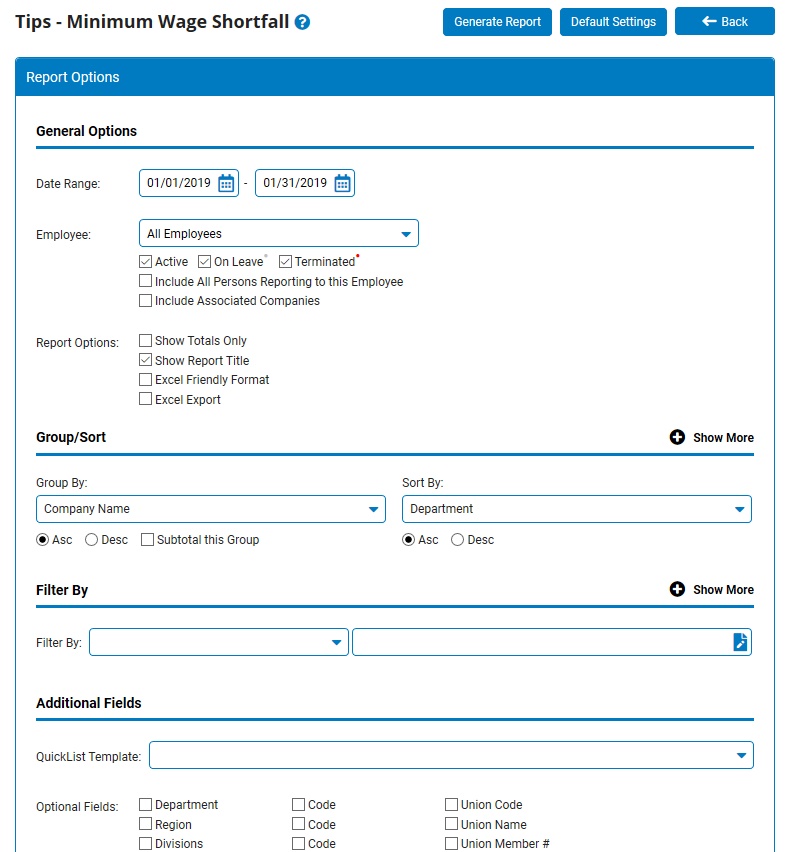

2. Click the Tips - Minimum Wage Shortfall link.

The Tips - Minimum Wage ShortfallTips - Minimum Wage Shortfall page displays.

3. Enter the start and stop dates for the pay period in which you would like to review hours worked at a rate below minimum wage in the Date Range fields.

4. If necessary, select a specific employee from the Employee drop-down box to view the report for that employee only.

Notes:

Leave the field set to All Employees to view a report including all employees at your company.

You can filter the list by active, on leave, and terminated employees.

You can choose to include all employees who report to the selected employee.

If you have multiple companies under one parent company, you can choose to include all companies.

5. To format the report by grouping, sorting, or filtering the results, see the Related Help Topics.

6. Click the Generate Report button.

Result: The report you selected displays in a new window with the options you selected.

Notes:

You may print the report by clicking the Print button.

You may close the report by clicking the Close button.

Related Help Topics:

Generating and Formatting a Report

Generating a Report Using a Template