The ExponentHR Recurring Items utility allows you to create payroll deduction adjustments for employees that are to be withheld in addition to the regular scheduled deductions. Through this utility you can create one-time or recurring deduction adjustments for items such as loan repayment, benefits deductions, gym memberships, or uniforms for example.

Notes:

Although you may add non-recurring (one-time) deduction adjustments through the Recurring Items utility, the preferred method is to do it through Miscellaneous Adjustments in Time Clock. See the Related Help Topics.

For setting up a 401(k) loan repayment, see the Related Help Topics.

To manage employee deductions:

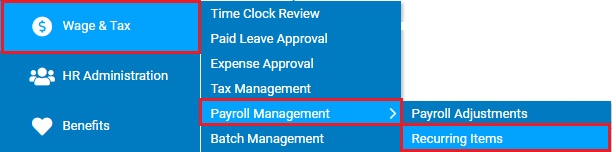

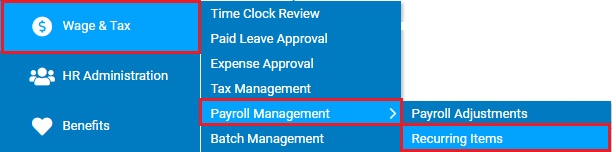

1. On the Management Navigation Menu, click Wage & Tax > Payroll Management > Recurring ItemsWage & Tax > Payroll Management > Recurring Items.

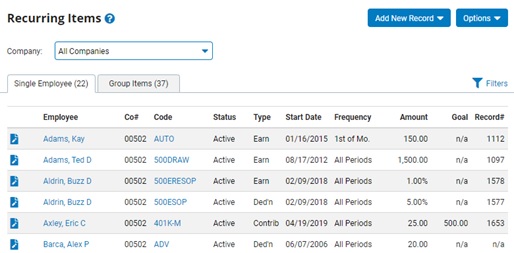

The Recurring ItemsRecurring Items page displays.

2. If necessary, filter the deductions according to a number of criteria.

Filtering Employee DeductionsFiltering Employee Deductions

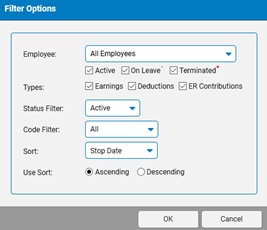

You may apply one or more filters to display only those adjustments you want to view by clicking on the Filters button and accessing the Filter OptionsFilter Options page.

1. You may view all adjustments for a specific employee by selecting the employee from the Employee drop-down box.

The Recurring Items page will display all adjustments that have been submitted on behalf of the employee you selected.

2. If necessary, uncheck the Earnings, Deductions, and/or ER Contributions check box in the Type portion of the page.

Only employee selected adjustment types will display on the Recurring Items page.

3. Additional filter options include being able to refine the list by the status or for a specific code

Result: The Recurring Items page will display only adjustments that match the criteria you selected. The number displayed in the Single Employee and Group Items tab reflects the total amount adjustments under the respective tab that meet all the filtering requirements that were specified.

The Recurring Items page updates to display all employee deductions falling under the filter criteria you selected.

3. Set up recurring and non-recurring deductions, as necessary.

Setting Up Recurring DeductionsSetting Up Recurring Deductions

|

All

of your new hires are required to purchase a uniform for work

in your organization. In order to make the expense of the

uniform easier to manage, the company has agreed to give the

employee the uniform and take $25 deductions from each paycheck

until the $100 uniform fee has been paid for. By setting up

recurring deductions for each employee (or as a group recurring

deduction that is applied to multiple employees), you will

be able to have this amount deducted from each paycheck without

remembering to deduct the amount on each payroll. |

You may set up recurring deductions that will be automatically debited from an employee's paycheck.

To set up a recurring deduction:

1. When creating a deduction adjustment, you have the option to create an adjustment for a single employee or an adjustment to be applied to a group of employees.

Click on the Single Employee or Group Items tab to create the respective type of deduction adjustment.

2. Click the Add New RecordAdd New Record button and select the Deductions option.

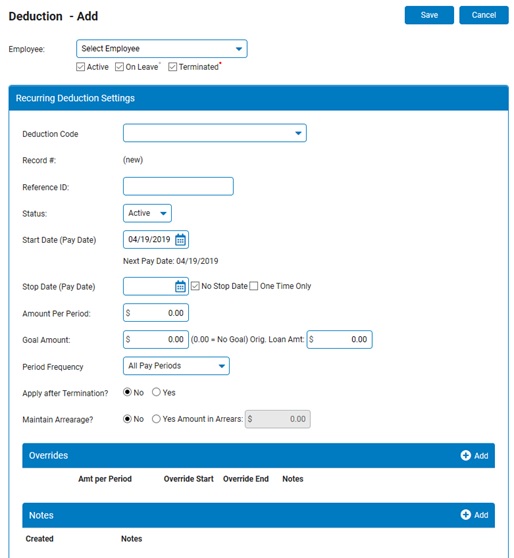

The Deduction - AddDeduction - Add page displays.

3. Select the employee to which you would like to apply the deduction adjustment from the Employee drop-down box. If creating a Group Recurring Item, click the Select Employees button to manage the list of employees that will be part of the recurring group.

4. Select a deduction type from the Deduction Code drop-down box.

The amount deducted from the employee's paycheck will be put toward the selected purpose (paying for medical insurance, repaying a student loan, etc).

5. If available, type the identification number provided by the third party administrator in the Reference ID text box.

6. Select whether the deduction is active or inactive from the Status drop-down box.

7. Enter the start date for the recurring deduction in the Start Date (Pay Date) field.

The deduction amount you entered will be taken out of the employee's paycheck for the first time on the start date you entered.

Notes:

This date must be a valid pay date at your company.

The next scheduled company pay date is listed below the field.

8. Set a stop date for the recurring deduction or set a goal for the deduction, as necessary. Or, set up a non-recurring deduction.

To set a recurring deduction to cease on a specific stop date:

1. Enter the date the deduction should cease in the Stop Date (Pay Date)Stop Date (Pay Date) field (you may also click the Calendar button to select the date from a calendar).

![]()

Result: The deduction amount you entered will be taken out of employee paychecks between the start date and stop date you entered.

Notes:

You may set a deduction to never expire by checking the No Stop Date checkbox. The deduction will continue to be applied to employee paychecks after the start date until you deactivate it.

You may also set up non-recurring deductions by checking the One Time Only checkbox. See the topic below for more information.

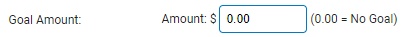

To set a recurring deduction to cease when a specific goal (or monetary amount) has been reached:

1. Enter a goal amount in the Goal AmountGoal Amount text box.

2. Type the original loan amount, if known, in the Orig. Loan Amt text box for reference purposes.

Result: The Anticipated Final Balance text box will adjust and display the amount of the last deduction needed to reach the goal, as well as the pay date that deduction will be processed. The Number of Pay Periods field will show the number of pay periods after the start date required to reach the goal you entered.

The deduction will automatically become inactive when the total monetary amount deducted from employee paychecks across multiple pay periods equals or exceeds a specific goal.

Note: If there is no goal amount and you want the deduction to continue until cancelled, leave the Goal Amount set at 0.00.

Setting a Non-Recurring DeductionSetting a Non-Recurring Deduction

1. Select the One Time Only check box to create a single non-recurring deduction that will be applied to the paycheck you specified in the Start Date box.

The Stop Date (Pay Date) field will automatically be populated with the same pay date as the Start Date.

9. Enter the monetary amount to be deducted from the employee's paycheck each pay period in the Amount Per Period text box.

10. Specify how often the deduction will be applied to the employee's paychecks by selecting an option from the Period Frequency drop-down box.

Note: You can choose all pay periods or specific payroll(s), such as the third payroll of each month. If you do not want the adjustment applied to a fifth paycheck in the month (if a calendar month includes five pay days), select the First 4 Payrolls of Month option.

11. If you want the deduction to apply to the employee's paychecks even after the employee is terminated, set the Apply After Termination radio button to Yes.

If the employee is terminated but is still receiving paychecks (severance pay or other), the deduction amount will also be applied to employee paychecks sent after the employee is terminated.

12. If you want the amount sent into arrears if it is excluded from a scheduled payroll so that the employee can catch-up on the missed deduction(s) automatically on the next applicable paycheck, select the Yes radio button.

The current amount in arrears for this deduction code and record number displays in the Amount in Arrears field.

Note: If set to No, you can still manually create an arrearage payment using the code.

13. Enter any notes related to the deduction in the Notes text box by clicking the Add button in the Notes section.

14. When you have entered all necessary changes, click the Save button.

Result: The employee deduction is saved and the Recurring Items page displays. The new deduction is now visible on the page and will be applied to the first paycheck you specified.

Editing DeductionsEditing Deductions

|

One

of your employees has agreed to contribute $15 a paycheck

to the United Way fund and as a result, a recurring deduction

has been set up for this employee. After the most recent United

Way campaign, the employee has asked that their contribution

rate be increased to $20 a paycheck. By editing the existing

employee deduction, you will be able to change the dollar

amount of the contribution without changing any of the additional

fields in the recurring deduction. |

You may adjust previously created recurring deductions by editing the deduction.

To adjust a previously created recurring deduction:

1. Click the Edit button on the row listing the deduction you wish to edit.

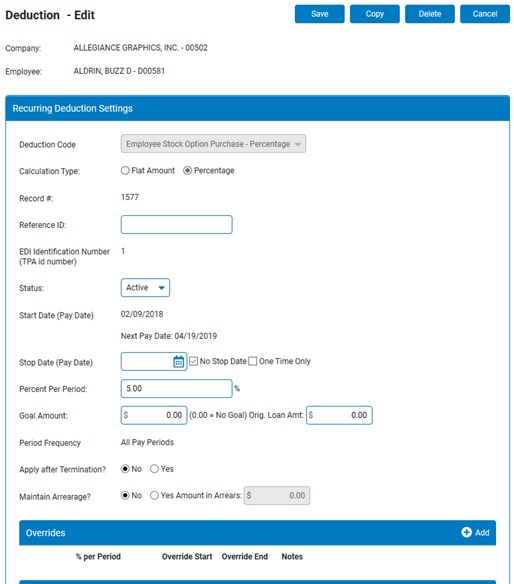

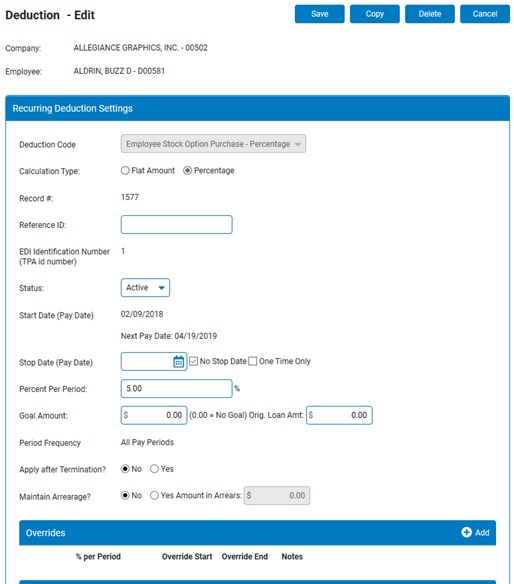

The Deduction - EditDeduction - Edit page displays.

2. If editing a Group Recurring Item, click on the Select Employees button to manage the list of employees that are receiving the recurring deduction.

Note: The View/Edit Records button on Group Recurring Items will display a list of all employees associated with the recurring deduction and the amount applied to date for each employee.

3. If necessary, you may activate the deduction or make it inactive.

To activate an inactive deduction, select Active from the Status drop-down box.

To suspend an active deduction, select Inactive from the Status drop-down box.

4. Edit the fields of this page as necessary to make other corrections or changes to the employee deduction.

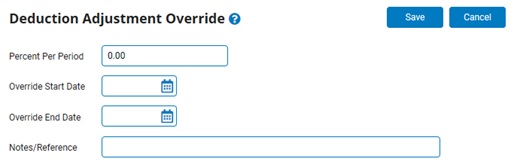

5. To make a temporary override to the scheduled deduction, click the Add button in the Overrides section.

The Deduction Adjustment OverrideDeduction Adjustment Override page displays where you can indicate the amount to apply each applicable pay period, as well as the effective start and end dates (inclusive) where during which the override amount will be applied. See the Related Help Topic.

6. When you have entered all necessary changes, click the Save button.

Result: The employee deduction is saved with your changes implemented.

Note: You may click the Cancel button to exit the page without saving your changes.

Deleting DeductionsDeleting Deductions

1. Click the Edit button on the row listing the deduction you want to edit.

The Deduction - EditDeduction - Edit page displays.

2. Click the Delete button.

Result: The employee deduction is deleted and the Earnings/Deductions Adjustments page displays. The deduction is no longer visible on the page.

Importing Recurring Deduction for Multiple Employees

Related Help Topics

Managing Employee Recurring Earnings

Setting up Recurring Employer Contribution Adjustments

Setting Up 401(k) Loan Deductions

Making Retirement Plan Adjustments

Setting Up Recurring Item Temporary Overrides

Applying Miscellaneous Adjustments through Time Clock

Importing Recurring Items for Multiple Employees

Generating a Report on Recurring Items